Give Darden Restaurants (NYSE:DRI) credit for beating the logic. Normally, when major figures like Jefferies start to say that consumer spending is in open decline, that should mean a drop in stocks like Darden. But the restaurant operator is actually up modestly in Thursday afternoon’s trading.

Jefferies analysts cut both the price target and rating, going from Hold to Underperform and lowering the price target from $154 to $124. The biggest reason? People aren’t spending as much anymore, and with consumers pulling in their collective wallets, it’s a safe bet that business profits are going to start to drop, kicking off a likely recession ahead.

It also doesn’t help matters that inflation is still running high. Yes, it’s recovered somewhat in the last few months, but that really doesn’t help the fact that prices are still increasing at a higher rate than normal right now on top of the massive surge in inflation already seen over the past few years.

Darden’s Unlikely Strategy

Under normal circumstances, this should be a terrible bit of news for Darden, but it’s got an unlikely plan to recover. If people are spending less, Darden reasons, the answer is to charge surviving patrons more. Reports note that Darden’s Olive Garden locations will continue their battle plan of getting blood from turnips and hike prices by an additional 2-3% in the wake of declining customer counts.

Here’s where things get interesting: a recent Business Insider report sent a reporter to both The Capital Grille and LongHorn Steakhouse—both Darden brands—to see who offered the better food. Said reporter ordered the same meal—French onion soup, steak, and cheesecake—and discovered that the lower-priced LongHorn served up a better value than the more upscale Capital Grille.

Is DRI a Good Stock to Buy?

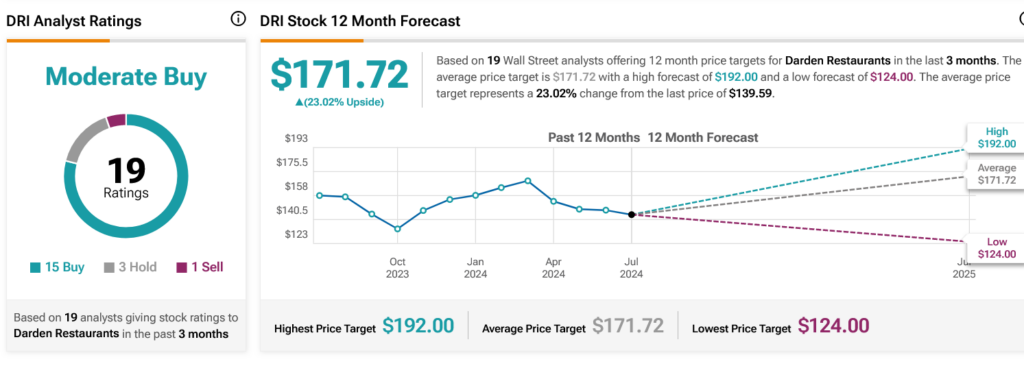

Turning to Wall Street, analysts have a Moderate Buy consensus rating on DRI stock based on 15 Buys, three Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 13.19% loss in its share price over the past year, the average DRI price target of $171.72 per share implies 23.02% upside potential.