Constellation Brands has received the long-awaited consent order from the US Federal Trade Commission (FTC) to divest some of its wine and spirits portfolio to California-based E. & J. Gallo Winery. The deal is likely to close in early January of 2021.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Constellation Brands (STZ) said that the divestment includes “a portion of Constellation’s wine and spirits portfolio principally priced at $11 retail and below, including certain related facilities located in California, New York, and Washington state.”

The alcohol beverage company had first announced the $1.7 billion deal in April 2019, but revised it twice in December 2019 and then in May 2020 to address concerns raised by the FTC. In May 2020, the deal price was reduced to $1.03 billion, of which “$250 million is an earnout if brand performance provisions are met over a two-year period after closing,” the company said.

Separately, the FTC has now also approved Constellation’s deals to sell the Paul Masson Grande Amber Brandy brand to Sazerac and to offload some of the brands from its grape juice concentrate business to Vie-Del Company. In addition, the FTC has also cleared the sale of Constellation’s Nobilo wine brand to Gallo. (See STZ stock analysis on TipRanks)

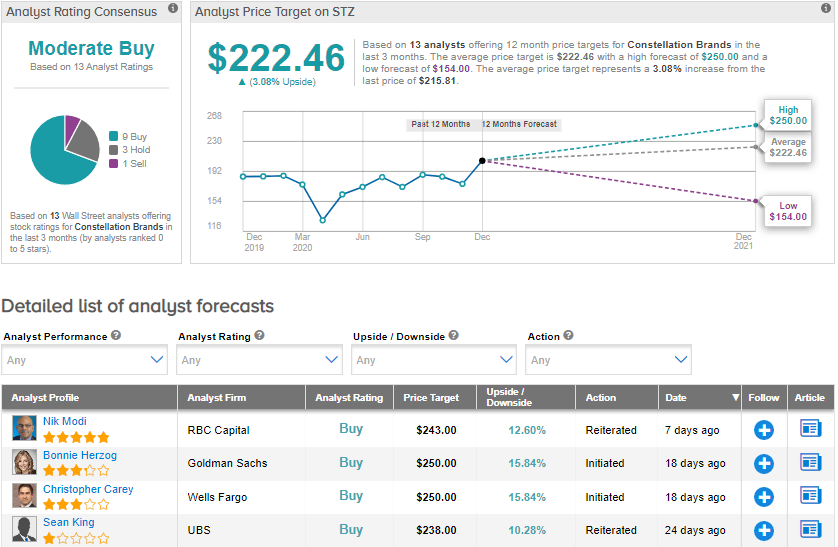

On Dec. 23, MKM Partners analyst William Kirk maintained a Sell rating on the stock with a price target of $154 (28.6% downside potential). The analyst said that “Following the sale of Ballast Point (Dec 2019), Constellation does not have scale in Craft Beer. Remaining brands like Funky Buddha (2017 acquisition) and Four Corners are sub-scale and respective tap rooms have likely struggled.”

Unlike Kirk, the Street has a cautiously optimistic outlook on the stock. The Moderate Buy analyst consensus is based on 9 Buys, 3 Holds and 1 Sell. The average price target stands at $222.46 and implies upside potential of about 3.1% to current levels. Shares have climbed 13.7% year-to-date.

Related News:

Apollo-Led Group Inks $3B Deal To Buy Stake In AB InBev’s US Container Plants

Caesars to Sell Southern Indiana Operation for $250M

Tenet Scraps $350M Hospital Deal As US Regulator Files Lawsuit