It appears that beer consumption is on the decline, at least according to Bank of America Securities. As a result, the investment firm downgraded beverage company Constellation Brands (STZ) from Buy to Hold and stated that the decline in beer goes beyond economic factors. Indeed, four-star analyst Bryan Spillane noted that given Constellation’s 15% market share, growth is slowing down due to market saturation.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

This could cause investors’ patience to be tested, which could lead to an underwhelming stock performance. In fact, the analyst believes the stock will stay range-bound for a while. Spillane also reduced his price target for STZ by 15% to $255 and lowered FY26 and FY27 sales forecasts due to limited evidence of an acceleration in beer sales.

Despite mixed second-quarter results, where softer wine and spirits sales were balanced by stronger sales of Modelo brands, Spillane kept FY25 EPS estimates unchanged at $13.77 but slightly lowered FY26 and FY27 EPS forecasts.

Market Research Suggests Beer Market Growth

Interestingly, the global beer market is actually expected to grow steadily, according to Expert Market Research. Indeed, it projects a growth rate of about 3% annually from 2024 to 2032, which will be driven by factors such as rising disposable incomes and an increasing demand for craft beers and premium products.

Separately, Fortune Business Insights states that Asia-Pacific is currently the largest market for beer due to rapid urbanization and a growing beer culture. In addition, North America is anticipated to be the fastest-growing region as younger consumers prefer craft beers and non-alcoholic beverages.

Does this mean that Bank of America is wrong? Not necessarily. Instead, both are potentially right. Whereas Expert Market Research is projecting growth eight years out, Bank of America is taking a more short-term view. Therefore, it’s possible that beer consumption will slow down over the next couple of years but resume growing after.

Should You Buy or Sell STZ?

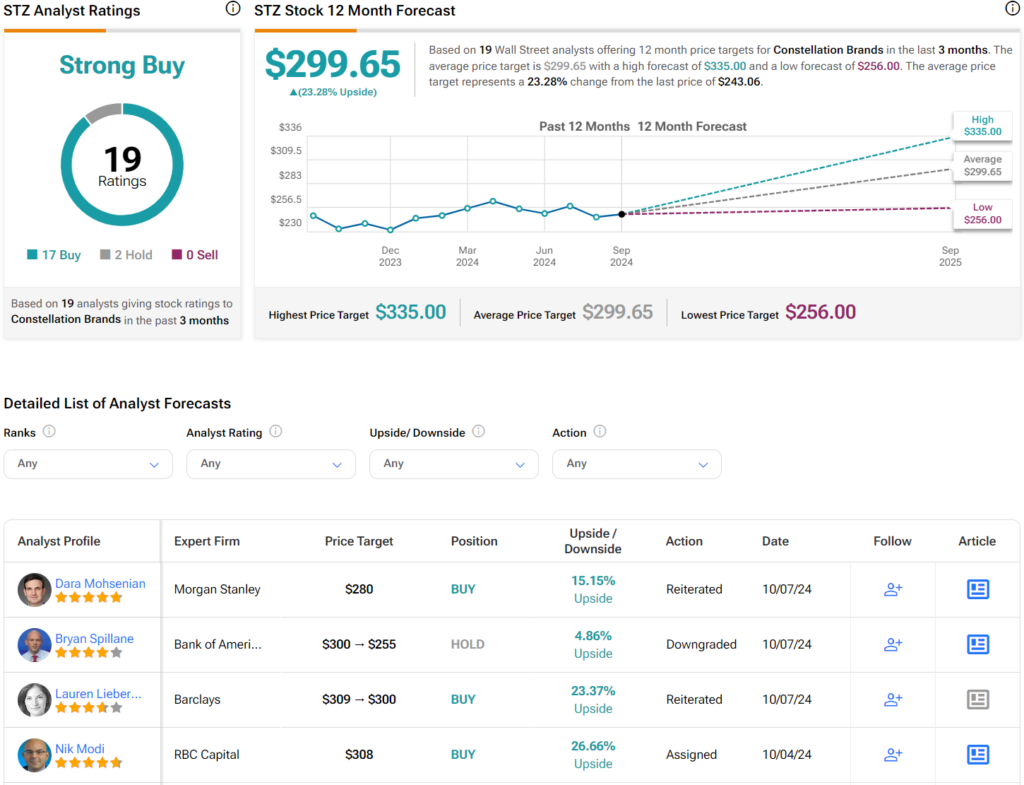

Overall, analysts have a Strong Buy consensus rating on STZ stock based on 17 Buys, two Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. After a 5% rally in its share price over the past year, the average STZ price target of $299.65 per share implies 23.28% upside potential.