Shares of Palantir (NYSE:PLTR) gained over 27% in after-hours trading after the company reported earnings for its first quarter of Fiscal Year 2023. Earnings per share came in at $0.05, which beat analysts’ consensus estimate of $0.04 per share. Sales increased by 17.8% year-over-year, with revenue hitting $525.19 million. This beat analysts’ expectations of $505.94 million.

Palantir’s segments all featured substantial growth. Its U.S. revenue, for example, reached $337 million, a 23% jump against this time last year. Commercial revenue worldwide, meanwhile, added 15% year-over-year to reach $236 million. Worldwide government revenue hit $230 million, which was up 22%. Even Palantir’s customer counts were substantially higher, growing 41% year-over-year and 7% just since last quarter.

Further, Palantir management offered some future projections. Palantir expects revenue to come in between $528 million and $532 million, faltering against consensus estimates looking for $536.2 million. For the full year 2023, things look slightly better; Palantir expects earnings between $2.185 billion and $2.235 billion, in line with expectations of $2.2 billion.

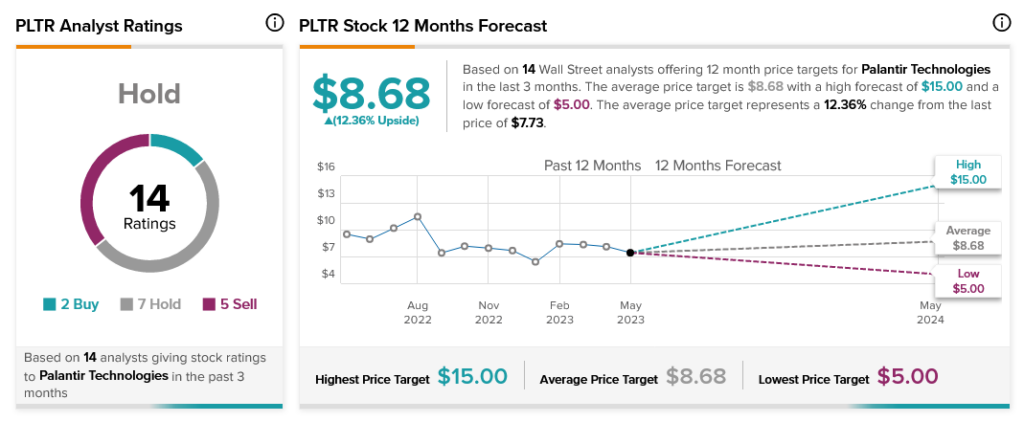

Overall, Wall Street has a consensus price target of $8.68 on Palantir stock, implying 12.36% upside potential, as indicated by the graphic above.

Questions or Comments about the article? Write to editor@tipranks.com