With potential buyers emerging for parts of Intel (INTC), or the whole company, the chipmaker may not be recognizable in a few months. But Intel shares are surging nonetheless despite all the changes, as shares are up over 6% in Wednesday trading.

Concerns are starting to emerge over Intel’s position in the personal computer (PC) gaming market. At least, that is the word from some media reports, which highlight concerns over the Battlemage line of graphics processing units (GPUs). Remarks from Intel CEO Pat Gelsinger put the gaming magazine on edge, especially once he said that he sees “…less need for discrete graphics in the market going forward.”

This in turn led to concerns about the whole Arc gaming graphics concept, which was looking for several models to follow. The Alchemist, Celestial and Druid iterations were set to follow, but with Gelsinger expressing doubt over the status of discrete graphics, those models may never see the light of day.

Cost Cutting Measures

Some of Intel’s cost-cutting measures might be getting pared back. Remember when Intel shutdown its free coffee and its company cars? Well, free coffee is back on the menu at some Intel locations and the company car may be making a comeback as well. Reports cite, “…the impact of small comforts” on employee morale, which has been somewhat sluggish following recent layoffs at the company.

Also, the recent Trump electoral win might be big news for Intel, which is currently building a new plant in Ohio. In fact, it may well halt the planned production facility, as there are signs that Trump would try to repeal the CHIPS and Science Act that prompted the build in the first place. With Trump calling the act bad, that suggests a Trump-leaning government may move to scrap the funding deal.

Is Intel a Buy, Hold or Sell?

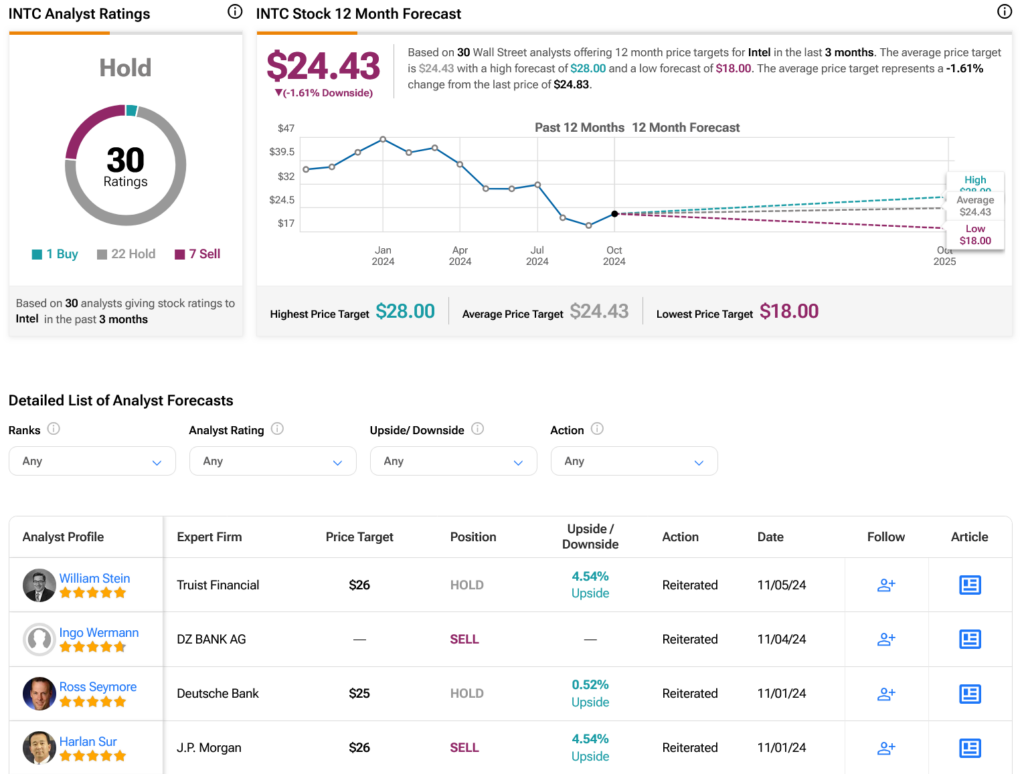

Turning to Wall Street, analysts have a Hold consensus rating on INTC stock based on one Buy, 22 Holds and seven Sells assigned in the past three months, as indicated by the graphic below. After a 35% loss in its share price over the past year, the average INTC price target of $24.43 per share implies 1.61% downside risk.