Shares of Compass (COMP) gained 2.1% in early trading hours on Tuesday after its Q2 results exceeded analysts’ expectations. Compass is a real estate technology company that empowers its residential real estate agents to deliver exceptional services through its end-to-end platform.

Net loss per share came in at $0.02, much below the Street’s estimates of a loss of $0.13. Also, it compares favorably with a loss of $0.77 in the last year’s quarter.

Compass reported Q2 revenues of $1.95 billion, up 186% from the year-ago quarter. The same was above analysts’ estimates of $1.56 billion. The company’s agents were able to double the market share from 3.3% to 6.2% in the second quarter. (See Compass stock charts on TipRanks)

Its agents closed 65,743 transactions, up 140% year-over-year. Also, Compass entered 15 new markets in the second quarter, bringing the total markets served to 62 at the end of the quarter.

For Q3, the company expects to report revenue in the range of $1.65 billion to $1.75 billion. Also, full-year 2021 revenue is expected to be between $6.15 billion and $6.35 billion, compared to the prior guidance of $5.35 billion to $5.55 billion.

Last month, Oppenheimer analyst Jason Helfstein reiterated a Buy rating on the stock with a price target of $25 (upside potential of 57.4%). Helfstein expects the company to report a loss per share of $0.53 in the third quarter of 2021.

Overall, the rest of the Street has a bullish outlook on the stock, with a Strong Buy consensus based on 5 Buys and 1 Hold. The average Compass price target of $23 implies upside potential of about 44.8% from current levels.

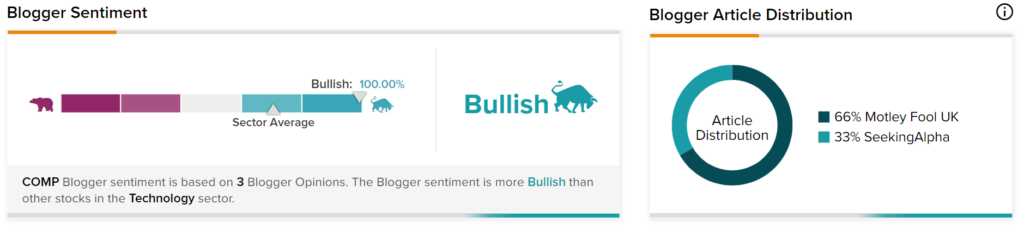

TipRanks data shows that financial blogger opinions are 100% Bullish on COMP, compared to the sector average of 71%.

Related News:

Air Products Reports Mixed Q3 Results; Shares Tank 5.2%

Immunovant Q2 Loss Meets Analysts’ Expectations

Vontier Delivers Better-Than-Expected Q2 Results; Street Stays Bullish