Columbus McKinnon Corporation (CMCO), a global leader in material handling products and systems, delivered solid Q4 results driven by increased order volume. Shares gained 1% to close at $51.87 on May 26.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

The company reported Q4 revenue of $186.23 million, down 1.7% year-over-year but outpaced the Street’s estimates of $180.02 million.

EPS for the quarter stood at $0.50 surpassing the Street’s estimates of $0.47 but down 13.8% year-over-year.

Annual revenue and EPS came in at $649.64 million and $1.16, down 19.7% and 58.3%, respectively, compared to the prior-year period.

Backlog stood at $171.7 million, up 31% and Orders increased 6% year-over-year.

Columbus McKinnon is a leading worldwide designer, manufacturer, and marketer of motion control products, technologies, systems, and services that efficiently and ergonomically move, lift, position, and secure materials. (See Columbus McKinnon stock analysis on TipRanks)

Commenting on the results, David Wilson, President, and CEO of the company said,” “We ended fiscal 2021 on a high note with orders growing in both our project and short cycle businesses. While the year was challenged with the impact of the global pandemic and resulting recession, we employed the tools of the Columbus McKinnon Business System to keep our momentum building and make our Company stronger… Since entering fiscal 2022, we have successfully issued equity, restructured our debt and are well-positioned to quickly de-lever our balance sheet.”

Projecting revenue for Q1 FY22 to be in the range of $212 to $217 million, Mr. Wilson said, “We are encouraged with growing demand for our lifting solutions as customers release projects and short cycle order trends improve. We are also excited about the addition of Dorner to our relevant portfolio of intelligent motion solutions and are seeing strong demand for high-precision conveying solutions. In fact, the business ended April with a record backlog, further confirming our conviction in the value of this acquisition.”

The Street estimates Q1 FY22 revenue to be pegged at $203.76 million.

Following the strong Q1 results, Barrington analyst Christopher Howe lifted the price target on the stock to $78 (51.9% upside potential) from $67 while maintaining a Buy rating.

Howe said, “We are in favor of the acquisition given its revenue growth, healthy margin profile and solid free cash flow generation. Furthermore, Dorner expands the company’s reach into industrial automation and offers attractive end market exposure in Food Processing, Life Sciences and E-Commerce… We believe there is potential for multiple expansion in consideration of the company’s improving fundamentals and its peers.”

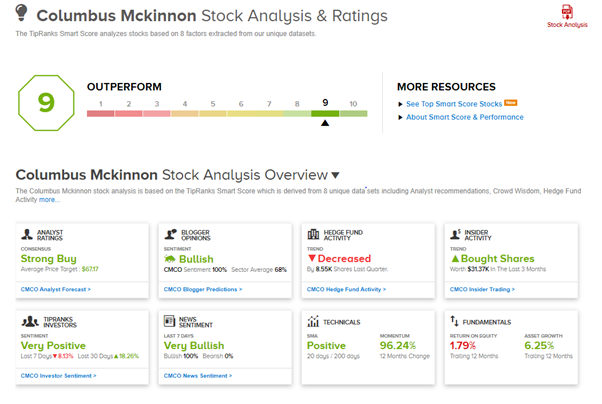

Overall, the stock has a Strong Buy consensus rating based on 6 unanimous Buys. The average analyst price target of $67.17 implies 29.5% upside potential from current levels. Shares have gained 64.6% over the past year.

Columbus McKinnon scores a 9 of 10 from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

DoubleVerify Reports First Public Results; Shares Pop 5.4%

Urban Outfitters Delivers Strong Q1 Results, Beats Expectations

Intuit Reports Lower-Than-Expected Q3 Results, Raises Guidance