Give cryptocurrency exchange Coinbase Global (COIN) credit, it is already planning moves for the 2026 election, even though the outcome of the 2024 election is still in doubt.

Don't Miss Our New Year's Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Coinbase, along with a coterie of other firms, is piling cash into a political action committee (PAC) to support crypto-related political issues in the future. Specifically, Coinbase is putting $25 million into Fairshake, a PAC that focuses mainly on cryptocurrency issues, and supporting political candidates who are in favor of crypto.

Fairshake says it has raised about $78 million for the 2026 election. In fact, venture fund Andreessen Horowitz has put in about $23 million, with contributors looking to “…establish a practical regulatory framework that protects consumers while allowing the industry to grow.”

Not Everyone is Happy

Meanwhile, some unexpected issues are cropping up from within Coinbase. A Barron’s report noted that Coinbase insiders are looking to sell stock, and in a very big way. Executives and board members are planning to sell five million shares, and based on the closing price of $182.88 from last Friday, that would be worth about $909 million.

But there are also some concerns about Coinbase’s internal operations, particularly given that one of the leading cryptocurrency exchanges is not actively buying Bitcoin (BTC). Coinbase has established a $1 billion stock buyback plan, which did little to move the needle on the stock. Some analysts suggest that Coinbase would have been better off taking that billion dollars and buying Bitcoin to demonstrate its belief in the largest crypto.

Is Coinbase Stock a Good Buy?

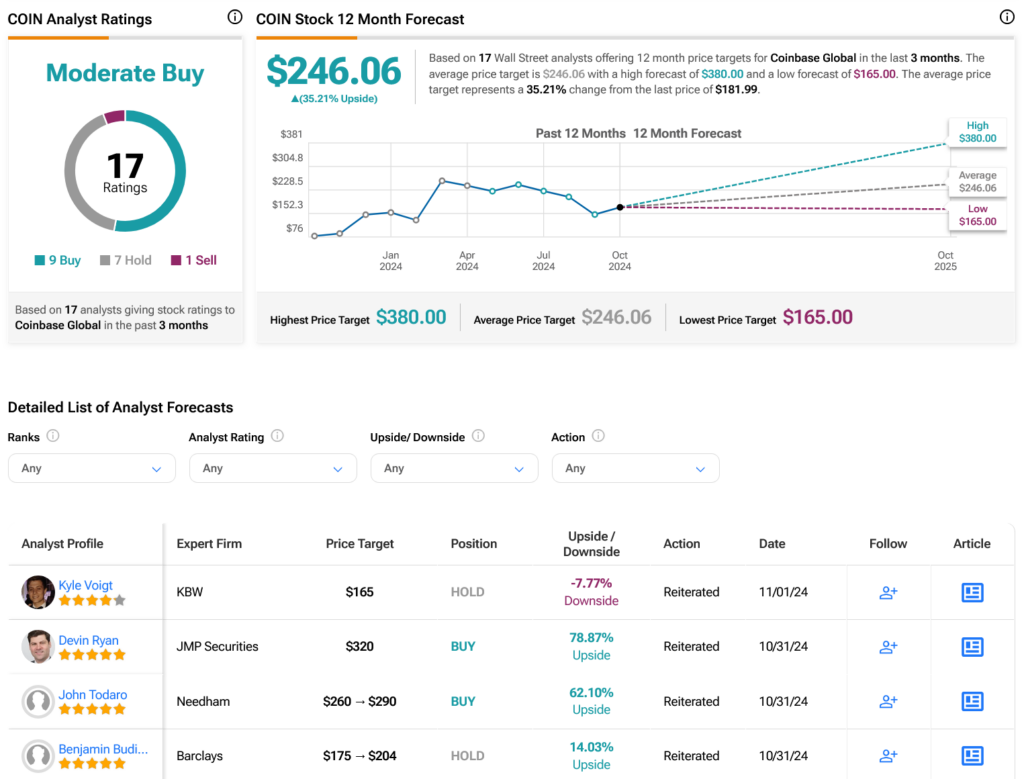

Turning to Wall Street, analysts have a Moderate Buy consensus rating on COIN stock based on nine Buys, seven Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 107.13% rally in its share price over the past year, the average COIN price target of $246.06 per share implies 35.21% upside potential.