Coinbase Global (NASDAQ:COIN) has filed for permission in the Southern District of New York, seeking an interlocutory appeal against the U.S. Securities and Exchange Commission’s (SEC) broad view of what constitutes an “investment contract” in digital asset transactions.

The cryptocurrency exchange has challenged the SEC’s definition of cryptocurrency transactions as “investment contracts” and argued that it exceeds legal limits. Moreover, COIN has argued that this constitutes legal overreach and “could stifle innovation.”

Legal Tussle Between COIN and SEC

The legal battle between Coinbase and the SEC started last year when the SEC filed a lawsuit alleging that Coinbase operates an unregistered securities exchange. The SEC argues that most cryptocurrency transactions should be subject to its oversight, with the exception of Bitcoin (BTC-USD).

However, Coinbase has disputed these allegations, arguing that cryptocurrency transactions are not securities and therefore cannot fall under the SEC’s jurisdiction.

Is COIN a Good Stock to Buy?

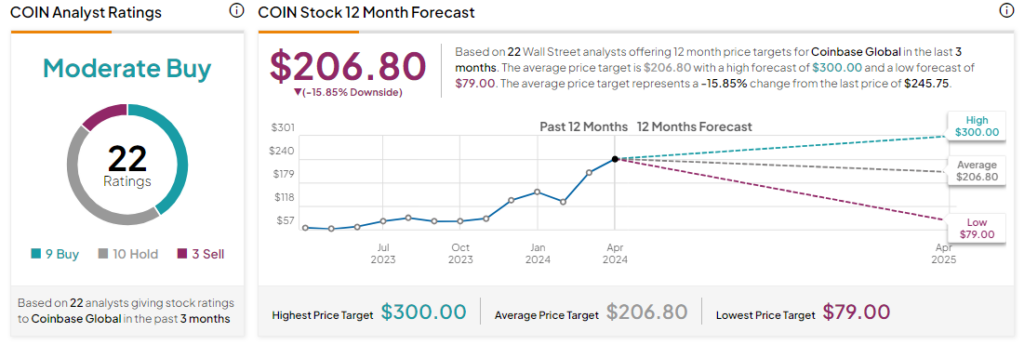

Analysts are cautiously optimistic about COIN stock, with a Moderate Buy consensus rating based on nine Buys, 10 Holds, and three Sells. Over the past year, COIN has surged by more than 200%, and the average COIN price target of $206.80 implies a downside potential of 15.8% from current levels.