The launch of low-cost Bitcoin (BTC-USD) ETFs (exchange-traded funds) could hurt Coinbase’s (NASDAQ:COIN) volumes and margins, says J.P. Morgan analyst Kenneth Worthington. According to a Reuters report, Worthington expects the cryptocurrency exchange to take a hit on its trading commissions and spreads as more investors may opt for exposure to the leading cryptocurrency through ETFs.

The Securities and Exchange Commission (SEC) recently approved Bitcoin ETFs, potentially expanding retail investors’ access to the digital currency without requiring direct ownership. This approval will likely boost the adoption of Bitcoin.

Citing similar concerns, CFRA Research analyst Michael Elliot downgraded Coinbase to Sell on January 16. Elliot believes that the introduction of the Bitcoin ETF could lead investors to explore alternative platforms.

Amid these challenges, let’s look at what the Street recommends for Coinbase stock.

Is Coinbase a Good Stock to Buy?

While the company faces headwinds from Bitcoin ETFs, Coinbase is currently entangled in a legal dispute with the Securities and Exchange Commission. The SEC contends that COIN breached securities laws by running its cryptocurrency asset trading platform without registering as a national securities exchange.

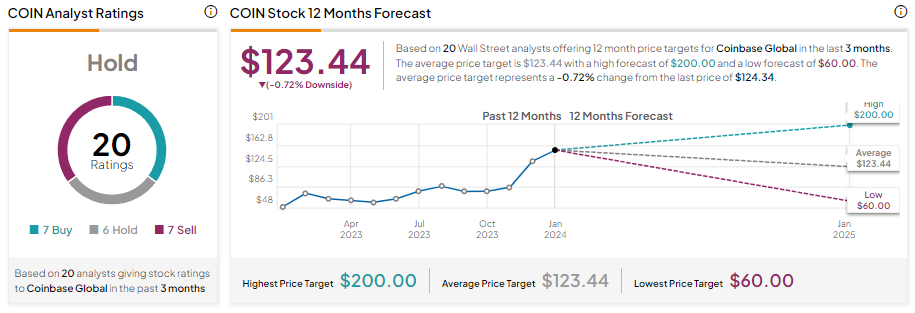

COIN stock has gained nearly 152% over the past year. Given its significant appreciation, analysts are sidelined on COIN stock. Coinbase stock has seven Buy, six Hold, and seven Sell recommendations for a Hold consensus rating. Further, analysts’ average price target of $123.44 shows marginal downside potential.

Questions or Comments about the article? Write to editor@tipranks.com