Cohu, Inc. (COHU), a provider of back-end semiconductor equipment and services, reported better-than-expected results driven by strong demand for its Mobility (RF testers and handlers) and Automotive EV/ADAS (handlers and contactors).

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Shares plunged 7.6% to close at $34.42 on July 29, as the company’s revenue projections did not meet investor expectations. (See Cohu stock charts on TipRanks)

Adjusted earnings for the quarter stood at $0.89 per share, showing significant growth over the prior-year quarter’s adjusted earnings of $0.17 per share. Analysts’ estimates stood at $0.79 per share.

Revenue came in at $244.8 million, growing 70% year-over-year and surpassed the Street’s estimate of $242.56 million.

During the second quarter, Cohu completed the sale of its Printed Circuit Board Test business, generating a gain of $75.8 million, and repaid $100 million of its Term Loan B facility.

Luis Müller, the company’s President, and CEO said, “Year-to-date results and our forecast put Cohu on track for record full-year revenue and profitability, benefiting from strong 5G mobility, automotive and improving consumer and industrial semiconductor demand.”

For the third quarter, Cohu projects revenue to fall in the range of $220 – $235 million. The company cautions of supply chain uncertainties, risks associated with book-and-bill, and customer acceptances as potential headwinds for its conservative Q3 outlook.

Following the results, Stifel Nicolaus analyst Brian Chin reiterated a Buy rating on the stock but lowered the price target to $51 (48.2% upside potential) from $58.

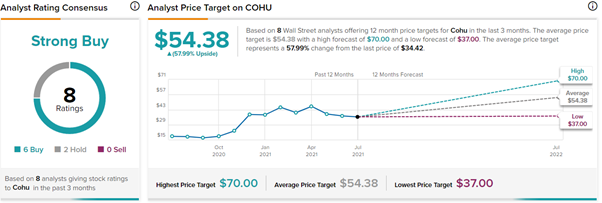

Overall, the stock commands a Strong Buy consensus rating based on 6 Buys and 2 Holds. The average Cohu price target of $54.38 implies 58% upside potential to current levels. Shares have gained 77.2% over the past year.

Related News:

Pfizer Delivers Blowout Quarter, Raises Guidance

Wingstop Q2 Results Top Expectations; Shares Fall Amid Inflationary Concerns

Hess Q2 Results Beat Expectations; Shares Jump