Shares of Coherent jumped 13.6% on Feb. 8 after the laser manufacturer announced a buyout bid from MKS Instruments, in a deal valued at $6 billion.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

According to the unsolicited proposal from MKS, each Coherent (COHR) share would be exchanged for $115 in cash and 0.7473 of MKS share. Shares of MKS dropped 8.1% to $149.24 at the close on Feb. 8.

The offer comes after Coherent last month entered into an agreement to be snapped up by Lumentum Holdings (LITE) in a cash and stock deal valued at $5.7 billion. Coherent stated that the company’s management determined that the takeover bid by MKS could lead to a transaction, which could be superior to its pending deal with Lumentum.

Coherent plans to enter into another round of discussions with MKS (MKSI), “to further evaluate the comparative benefits and risks of MKS’ proposed transaction relative to Coherent’s pending transaction with Lumentum, including the near and long term financial opportunities of each transaction, the expected completion timing of each transaction, and the closing risks associated with each transaction.”

Coherent said that its Board of Directors continues to recommend Lumentum’s acquisition offer to its shareholders. (See Coherent stock analysis on TipRanks)

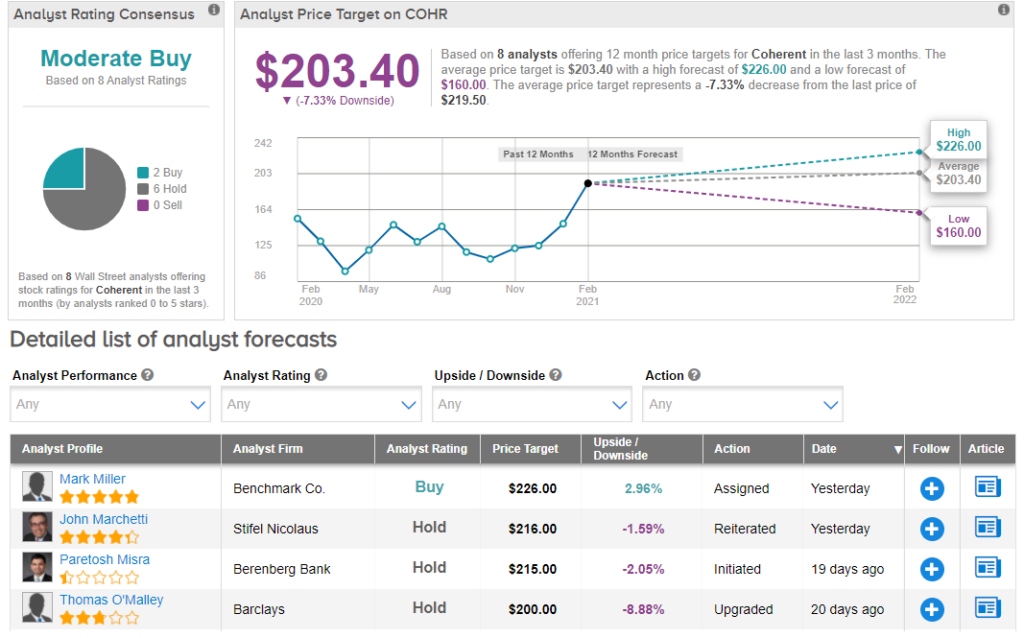

Following the MKS offer, Benchmark Co. analyst Mark Miller assigned a Buy rating and a price target of $226 on Coherent stock. Miller said, “While Lumentum serves complementary markets to Coherent with little overlap, due to some similar markets served by Coherent and MKS Instruments, we believe the deal could face scrutiny from regulators.”

The rest of the Street is cautiously bullish about the stock with a Moderate Buy consensus rating. That’s based on 2 analysts recommending a Buy and 6 analysts suggesting a Hold. The average analyst price target of $203.40 implies 7.3% downside potential to current levels.

Related News:

Cubic Inks $2.8B Buyout Deal With Veritas Capital, Evergreen; Shares Spike 10%

Palantir Partners With IBM To Provide AI-Driven Business Solutions

Hasbro Hits $1B In Online Sales In 2020 As Demand For Toys Booms