Cogeco Communications (TSE: CCA) recently reported earnings for its third quarter of Fiscal Year 2022, and earnings per share came in at C$2.16, which was below analysts’ consensus estimate of C$2.29. In the past nine quarters, the company has missed estimates only three times.

In addition, sales increased 16.6% year-over-year, with revenue hitting C$728.1 million compared to C$624.3 million. The revenue increase was primarily driven by growth in the United States.

More importantly, EBITDA increased by 17%, which means that the company saw operating leverage since it increased more than revenue. Indeed, the EBITDA margin expanded from 47.6% to 47.7%.

However, the company’s earnings only grew 7.5% versus the comparable period, and free cash flow decreased by over 20% to C$104.8 million due to increased capital expenditures.

Regarding Fiscal 2023 guidance, Cogeco expects revenue growth of 2%-4% and adjusted EBITDA growth of 1.5%-3.5%, but free cash flow is expected to decrease by 2%-12% due to increased growth expenditures. The stock is currently flat on the day after releasing the news.

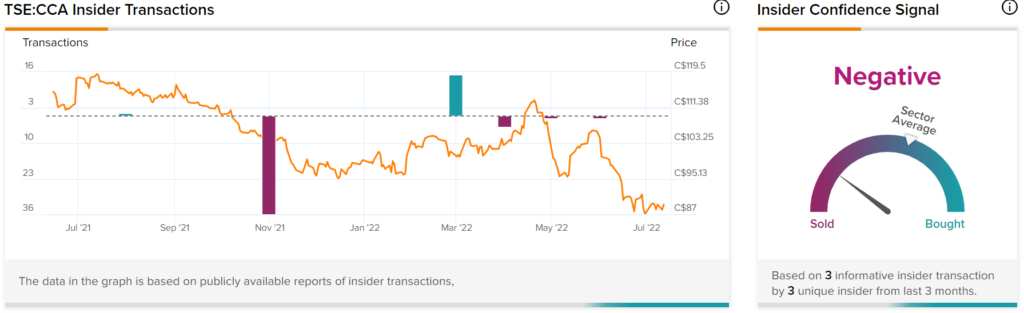

Insider Activity Reflects Low Confidence

When looking at insider activity, there doesn’t seem to be much enthusiasm. In fact, insiders have been selling in the past three months. As a result, confidence from within appears to be low, as the Insider Confidence Signal for CCA stock is negative and is below the sector average, as shown in the following picture:

Analysts’ Recommendations on Cogeco Stock

Cogeco has a Moderate Buy consensus rating based on three Buys and three Holds assigned in the past three months. The average CCA price target of C$116.91 implies 34.2% upside potential.

Final Thoughts – A Mixed Quarter, Mixed Investor Sentiment

Cogeco saw a mixed quarter, as revenue saw strong growth while earnings came in worse than expected. In addition, it’s worth noting that although analysts have a favorable view of the stock, insiders do not at the moment.