Capital One Financial (COF) reported disappointing second-quarter earnings due to a significant increase in provision for credit losses. Following the release of lower-than-expected Q2 results, COF stock declined about 1% in the extended trading session yesterday.

COF is a diversified bank that provides credit cards, auto loans, and banking services to consumers and businesses. (For a thorough assessment of COF stock, go to TipRanks’ Stock Analysis page.)

COF: Q2 Highlights

The company’s revenue increased 5% year-over-year to $9.51 billion but came below the consensus estimate of $9.57 billion. The top-line growth can be attributed to higher net interest and non-interest income.

However, the company reported adjusted earnings of $3.14 per share, which missed the consensus estimate of $3.39. Further, it compared unfavorably with EPS of $3.52 in the year-ago quarter.

This decline can be attributed to the increase in provision for credit losses. In Q2, the company set aside $3.9 billion to cover potential loan defaults, reflecting a 57% jump year-over-year. This is primarily due to the termination of a loss-sharing agreement with Walmart (WMT) for co-branded credit cards.

Acquisition Update

The company disclosed that it incurred $31 million in costs related to the ongoing Discover Financial Services (DFS) merger during Q2. During the earnings call, CEO Richard Fairbank said that the company is committed to completing the deal, citing its potential to create a strong payment platform.

It is worth mentioning that the merger, announced in February, is facing regulatory challenges. The proposed merger has raised concerns about stifling competition in the credit card industry.

The Best Analyst Covering COF Stock

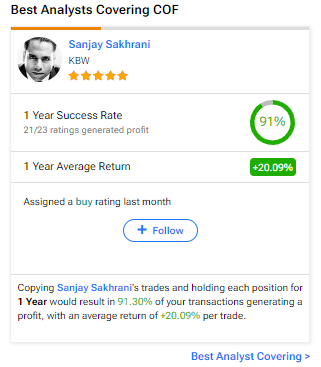

Interestingly, investors considering COF stock could follow KBW analyst Sanjay Sakhrani. He is the best analyst covering the stock (in a one-year timeframe). The analyst boasts an average return of 20.1% per rating and a 91% success rate. Click on the image below to learn more.

On June 18, Sakhrani, ranked among the top 1% of Street stock experts, reiterated his Buy rating on the stock with a price target of $175, suggesting a 29.3% upside potential. (To watch Sakhrani’s track record, click here.)

Is COF Stock a Good Buy?

Capital One’s near-term profitability might remain impacted by higher loan loss reserves. However, the company’s aim to expand its reach to include high-spending individuals might bolster its top line. Furthermore, the successful completion of the Discover acquisition bodes well for COF’s long-term growth.

Currently, COF has a Moderate Buy consensus rating based on four Buy and nine Hold recommendations. After a year-to-date rally of about 12%, the analysts’ average price target on Capital One stock of $154.80 per share implies 6.39% upside potential.

However, it’s worth noting that the company’s weak earnings report may cause analysts to lower their ratings.