Shares of Capital One Financial (COF) fell nearly 1% in extended trading yesterday, after the company reported mixed results for the fourth quarter of Fiscal 2024. Adjusted earnings per share (EPS) of $3.09 outpaced the Street’s estimate of $2.83 and also came in better than the $2.24 reported last year. Net revenue of $10.19 billion rose 2% year-over-year but missed the consensus estimate of $10.21 billion.

Meanwhile, the company confirmed that its plans to acquire Discover Financial Services (DFS) in a $35.3 billion all-stock transaction remain on track. COF shareholders are expected to vote on the much-awaited acquisition on February 18. The company hopes to complete the acquisition early this year, subject to shareholder approval and regulatory clearances.

Further Details of COF’s Financial Performance

For the full year, Capital One Financial’s net revenues rose 6% to $39.1 billion, while adjusted EPS improved to $13.96 from $12.52 in 2023. Additionally, COF noted that its Q4 and Fiscal 2024 results included pre-tax charges of $140 million and $234 million, respectively, related to the DFS integration expenses.

Capital One is one of the largest credit card players in the U.S. Consumer spending improved in the last quarter of 2024, as the U.S. Federal Reserve cut interest rates. In Q4, COF’s net interest income, the difference between interest earned on loans and paid on deposits, rose by almost 8% year-over-year to $8.1 billion. Meanwhile, non-interest income, which includes interchange income and customer-related fees, rose 5% compared to Q4 FY23. Capital One witnessed steady growth in its domestic card business coupled with solid loan originations and a revival in loan growth in the auto business.

Capital One remains under pressure due to the CFPB (Consumer Financial Protection Bureau) investigation. The Bureau alleges that COF misled its “high-interest” saving account customers and withheld nearly $2 billion in interest payments. COF has denied any wrongdoing and hopes to clear the allegations as the new administration under President Trump takes over the case.

Is Capital One a Good Buy?

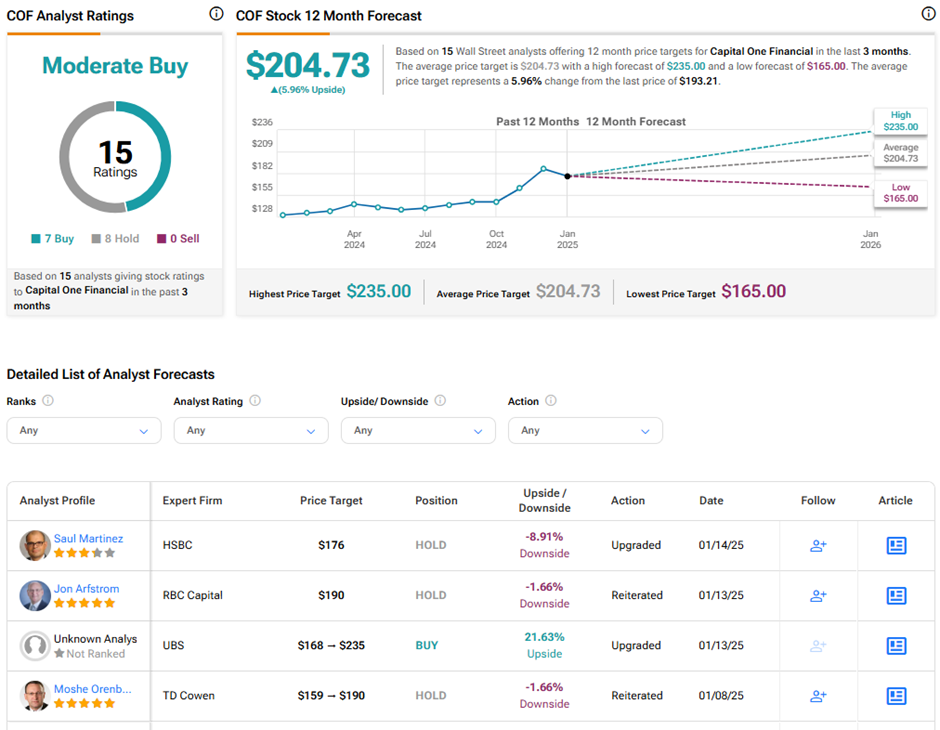

Analysts remain divided on Capital One stock due to the pending DFS acquisition and regulatory hurdles. On TipRanks, COF stock has a Moderate Buy consensus rating based on seven Buys and eight Hold ratings. Also, the average Capital One Financial price target of $204.73 implies a nearly 6% upside potential from current levels. In the past year, COF shares have gained 51.4%.

It is important to note that all these ratings were given before the Q4 results announcement and are subject to change once analysts review their recommendations on the stock.