Beverage giant The Coca-Cola Company (NYSE: KO) recently announced a quarterly dividend of $0.44 per share, a 4.8% increase from the previous dividend of $0.42 per share.

The dividend will be paid on April 1, 2022, to shareholders of record as of March 15, 2022.

Following the news, shares of the company gained 2% on Thursday. However, the stock pared its gains marginally to close at $62 in the extended trading session.

The company’s annual dividend of $1.76 per share now reflects a dividend yield of 2.8% based on Thursday’s closing price.

The company has been raising its dividend consistently over the past six decades, making it an attractive choice for investors.

Share Repurchase

The company is likely to renew its share repurchases with plans to repurchase shares worth roughly $500 million in the current year.

Stock Rating

Recently, Evercore ISI analyst Robert Ottenstein initiated coverage on the stock with a Buy rating and a price target of $70, which implies upside potential of 12.7% from current levels.

The analyst commented, “KO continues to improve its business model, portfolio, and long-term outlook. The last two years may have obscured progress, still the firm increased its global NARTD value share in the at-home and away from home channels above 2019 levels, while expanding its operating margin 100 bps over 2019 despite adverse channel mix. The cultural and organizational changes initiated in 2020 are starting to gel and the business looks primed for FX neutral results at or above the high end of its algorithm in 2022 and 2023, as the world recovers from Covid and mobility improves.

“Looking out further, we see the potential for continued 5-6% sales growth, operating leverage, steady MSD dividend increases, and share buybacks driving a double-digit return to shareholders. Moreover, we believe the firm’s asset light business model is better positioned to navigate an inflationary environment than most. Our PT goes from $63 to $70, based on a 26x multiple on C2023 of $2.70.”

The Wall Street community is cautiously optimistic about the stock with a Moderate Buy consensus rating based on 11 Buys and 4 Holds. The average Coca-Cola price target of $67.20 implies that the stock has upside potential of 8.2% from current levels. Shares have gained 22.4% over the past year.

News Sentiment

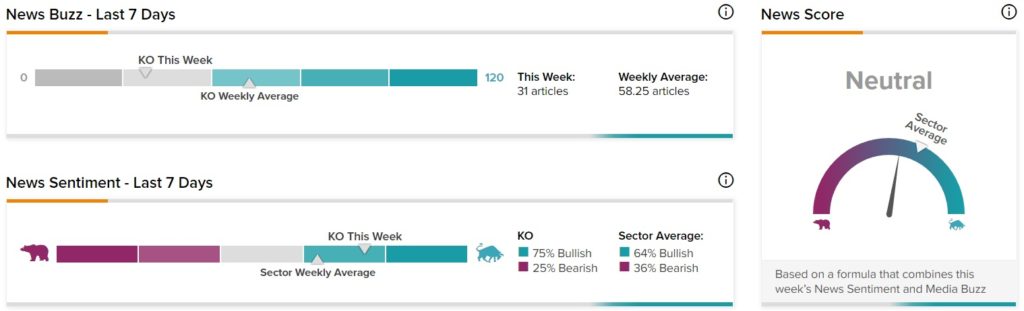

News Sentiment for KO is Neutral based on 31 articles over the past seven days. 75% of the articles have Bullish sentiment, compared to a sector average of 64%.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Fiverr Pops 10.8% on Strong Q4 Performance

Wix Drops 23% on Q4 Revenue Miss and Weak Guidance

Uber Exploring Crypto Payments for Rides – Report