Commodity and Futures Exchange leader CME Group (CME) today posted record trading results for Q3 2024 as well as for the month of September.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Average daily contracts reached 28.3 million for the three months ending September 30, while the latest month reached an average of 28.4 million daily volume. The results bode well for CME Group amid concerns about mounting competition in the space.

Although they pulled back by about 1% Wednesday following the news, shares of CME stock are in a bullish trend, having risen about 15% after reaching a one-year low back in July.

Despite CME stock’s recent gains, competitive concerns have been mounting as a result of BGC Group’s (BGC) launch of a competing Futures exchange during the 2nd half of September 2024. That company is supported by major commercial banks including Bank of America (BAC) and JP Morgan (JPM).

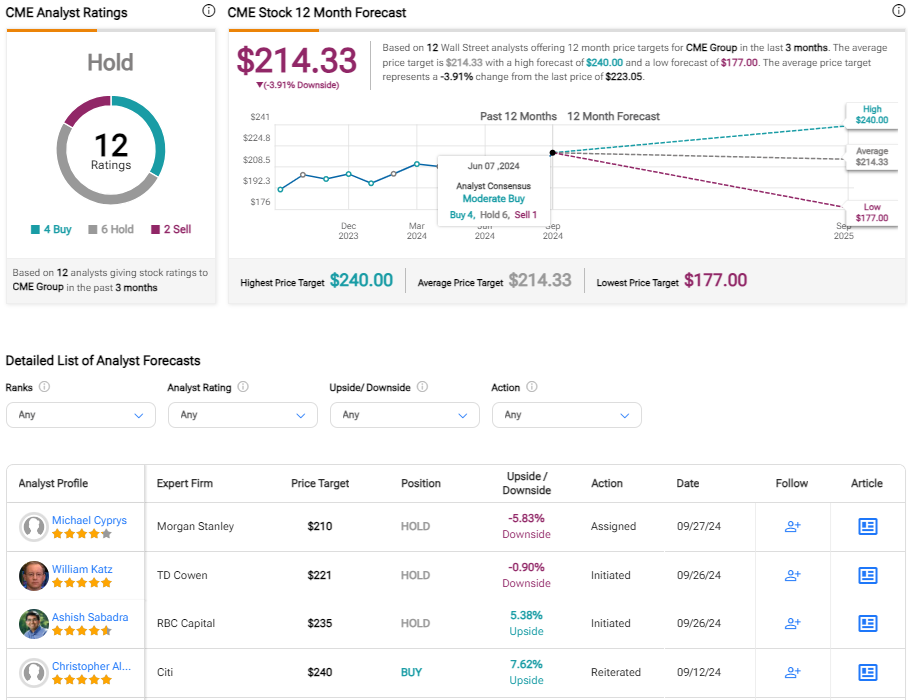

Wall Street analysts have a consensus Hold rating on shares of CME Group. Of the 12 analysts who cover CME Group, there are 4 Buy ratings, 6 Hold ratings, and 2 Sell ratings. The average CME price target is $214.33, which is about 4% lower than where shares were trading early Wednesday afternoon.