CMC Materials increased its quarterly cash dividend by 5% to $0.46 per share. The global supplier of consumable materials has been rewarding shareholders with cash dividends over the last 17 years.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

CMC Materials (CCMP) announced that the new dividend will be paid on April 23, to shareholders of record as of March 23.

The company’s annual dividend of $1.84 per share now reflects a dividend yield of 1.08%.

CMC Materials also increased its share repurchase program to $150 million. The company had $27 million of shares available under its current share repurchase program as of Dec. 31, 2020.

Earlier this week, CMC Materials inked a deal to acquire Nevada-based International Test Solutions (ITS), a designer and manufacturer of innovative, high-performance consumables used by semiconductor manufacturers, in a cash deal worth $125 million. The deal, which awaits regulatory approvals, is anticipated to close this April. (See CMC Materials stock analysis on TipRanks)

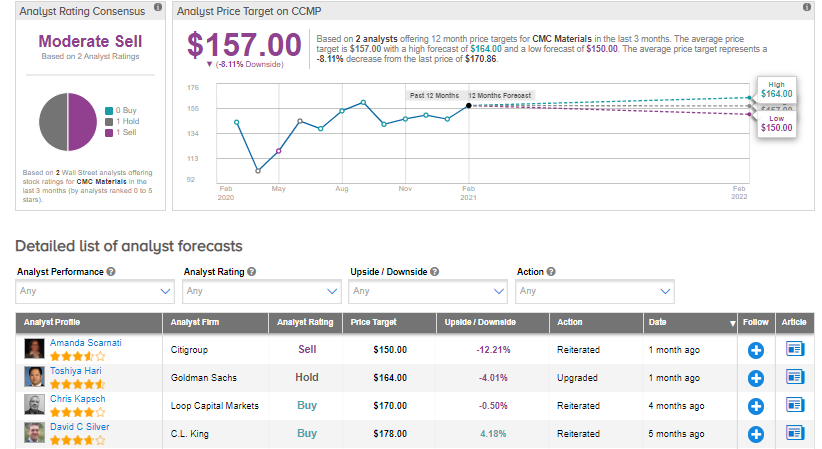

On Jan. 25, Citigroup analyst Amanda Scarnati lifted the stock’s price target to $150 (12.2% downside potential) from $140 and maintained a Sell rating. The analyst “updated estimates and price targets across semiconductor equipment and components to align with Citi’s updated wafer fab equipment estimates and expanded multiples driven by strong near term capex spend.”

The rest of the Street is cautiously bearish about the stock with a Moderate Sell consensus rating. That’s based on 1 Hold and 1 Sell. The average analyst price target of $157 implies 8.1% downside potential to current levels.

Related News:

Werner Bumps Up Quarterly Dividend By 11%; Street Sees 8% Upside

Installed Building Initiates Quarterly Dividend; Street Is Bullish

Allstate Ramps Up Quarterly Dividend By 50%; Street Sees 20% Upside