Cloudflare, Inc. (NYSE: NET) a web infrastructure and website security company reported better-than-expected Q4 revenue and in-line earnings, leading to a 4.3% gain during the extended trading session.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Aided by robust demand from large enterprise customers, NET’s dollar-based net retention rate advanced 600 basis points year-over-year to 125%. The company also recorded solid operating cash flow of $40.6 million and positive free cash flow of $8.6 million in the quarter. Shares closed up 1% at $115.96 on February 10.

Year-to-date, Cloudflare shares have lost 8.1% vis-à-vis registering a 49% gain over the past year.

Solid Results

Cloudflare’s Q4 revenue jumped 54% year-over-year to $193.6 million and outpaced analysts’ estimates of $184.85 million.

However, quarterly adjusted earnings came in-line with the consensus estimates of $0.00 per share. The number was better than the prior-year adjusted loss of 2 cents per share.

Moreover, for the full year fiscal 2021, NET reported revenue of $656.43 million, growing 52% annually. FY21 adjusted loss was 5 cents per share, better than FY20 adjusted loss of 12 cents per share.

CEO Comments

Pleased with the results, Cloudflare co-founder & CEO, Matthew Prince, said, “Our continued success is fueled by a culture of relentless innovation on top of a highly scalable platform. That’s why we’re uniquely positioned to extend our network, introduce new Zero Trust capabilities, and grow our total addressable market. We’ve never been more motivated to take on this huge opportunity as corporate networks transition to the cloud, and developers line-up to build on our edge.”

Upbeat Outlook

Based on the current business momentum and economic environment, Cloudflare forecasts Q1FY22 revenue to be between $205 million and $206 million and adjusted earnings to be between $0.00 per share and $0.01 per share. The consensus estimates for the same are pegged at $195.81 million and ($0.01) per share, respectively.

For the full year fiscal 2022, the company forecasts revenue in the range of $927 million to $931 million, significantly higher than the consensus estimate of $888.44 million.

Similarly, FY22 adjusted earnings are projected to be between $0.03 per share and $0.04 per share, exceeding the consensus estimate of $0.02 per share.

Target Price

The Wall Street community is cautiously optimistic about the stock with a Moderate Buy consensus rating based on 9 Buys, 6 Holds, and 1 Sell. The average Cloudflare price target of $155.56 implies 34.1% upside potential to current levels.

Stock Investors

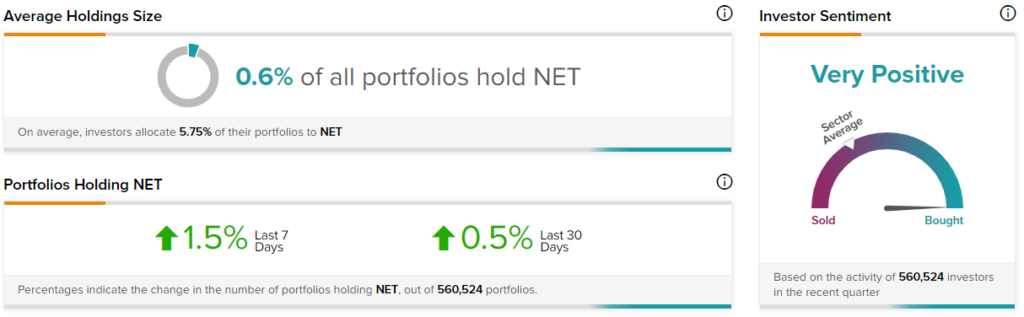

TipRanks’ Stock Investors tool shows that investor sentiment is currently Very Positive on Cloudflare, with 1.5% of portfolios tracked by TipRanks increasing their exposure to NET stock in the last 7 days.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Uber Soars on Stellar Q4 Results, Outpaces Expectations

XPeng Gains 9.6% on Inclusion in the Shenzhen-Hong Kong Stock Connect Program

Alibaba Surges after SoftBank Denies Stock Sale Speculation – Report