Shares of Clean Energy Fuels (CLNE) jumped 2.2% in Monday’s extended trading session after closing 3.4% higher on the day. The company revealed its investment plans to develop renewable natural gas (RNG) from dairies and other agricultural facilities at its AGM.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Clean Energy Fuels is the leading provider of renewable natural gas (RNG) for the transportation industry enabling thousands of vehicles to reduce their greenhouse gas emissions.

The investments will be made both independently and with partners TotalEnergies (TOT) and BP plc (BP).

Furthermore, Clean Energy launched a new company logo and a new website. (See CLNE stock analysis on TipRanks)

Clean Energy CEO Andrew J. Littlefair commented, “Clean Energy’s business has pivoted to focus on an extraordinary renewable, non-fossil fuel that can actually reduce fleets’ carbon footprint by as much as 500.”

He further added, “The logo, color scheme, messaging, website and other brand elements that we introduced today denote a circular economy, where organic waste is turned into sustainable fuel, and embodies the role Clean Energy plays in helping our planet.”

RNG currently makes up 70% of the fuel sold at Clean Energy’s network of stations, and the company stated that it is on track to provide the fuel at all of its stations by 2025.

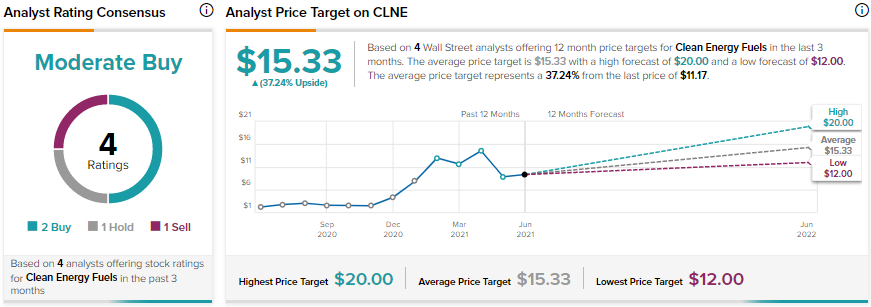

Needham analyst Vikram Bagri recently initiated coverage on CLNE with a Buy rating and the price target of $12 (7.4% upside potential).

Bagri believes that CLNE’s collaboration with the leaders in the clean energy industry positions it to form a vertically integrated RNG value chain that would be difficult to imitate.

Overall, the stock has a Moderate Buy consensus rating based on 2 Buys, 1 Hold, and 1 Sell. The CLNE average analyst price target of $15.33 implies 37.2% upside potential from current levels. Shares of CLNE have jumped 410% over the past year.

Related News:

United Airlines Launches Corporate Venture Capital Fund; Shares Drop 1.7%

Medtronic Receives FDA Approval for Neurostimulator; Shares Rise 1.4%

Occidental Petroleum Divests Non-Strategic Permian Basin Acreage for $508 Million