Banking giant Citigroup (NYSE:C) continues its restructuring spree as it eliminates more leadership roles. According to a Reuters report, the bank’s CEO, Jane Fraser, held a conference call on Thursday with its managing directors to discuss this overhaul.

The report stated that managers in markets, risk, and investment banking businesses were let go as part of the bank’s reorganization efforts. Some managers have been told their positions would cease from February 1.

According to Reuters, Citi will slash its headcount by 5,000 in the current reorganization, while another 5,000 employees will be let go from its “selling businesses.” The bank also plans to lay off an additional 10,000 employees from its support functions like technology and operations. Citi’s decision to reduce its workforce by around 8% ranks among the most significant layoffs on Wall Street in recent times.

The bank had indicated last week that it intended to slash 20,000 jobs over the next two years. Citi had a tumultuous fourth quarter as it saw a $1.8 billion loss on revenues of $17.4 billion.

Is Citibank Stock a Buy or Sell?

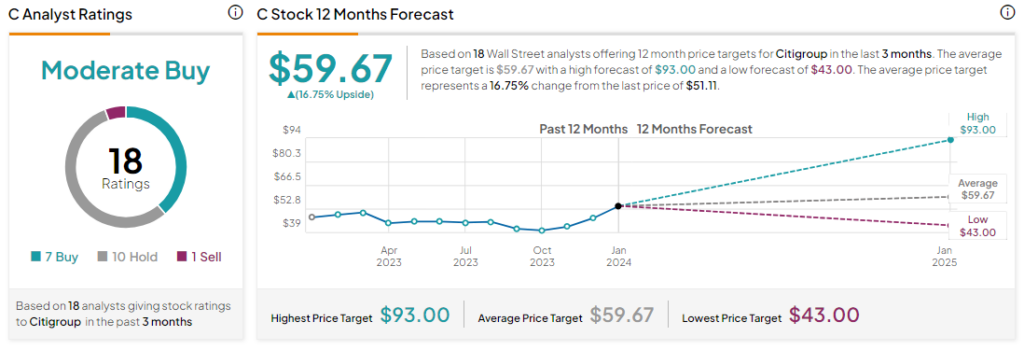

Analysts remain cautiously optimistic about Citi stock with a Moderate Buy consensus rating based on seven Buys, 10 Holds, and one Sell. Over the past year, Citi stock has gone up by more than 6%, and the average Citi price target of $59.67 implies an upside potential of 16.8% at current levels.