Citigroup (NYSE:C) recently reported its Q1-2024 earnings results, which I’ll discuss in detail. In a nutshell, the bank showed better operating momentum compared to the last quarter of 2023, although on a year-over-year (Y/Y) basis, revenue is still down while expenses are growing. Still, I am bullish on the stock, as Citigroup is set to benefit from restructuring efforts and asset sales, with business momentum expected to pick up in the remaining quarters of the year, as implied by the unchanged full-year outlook.

My bull case rests on an attractive tangible book discount (tangible book value of $86.67 compared to a $59.68 share price), which provides a sizable margin of safety should its operating momentum remain subdued despite optimistic expectations from management.

Citigroup Operational Overview

Citigroup reports results in six main operating segments: U.S. Personal Banking at 24.5% of Q1-2024 revenues, Services at 22.6% of revenues, Markets at 25.5%, Wealth at 8%, Banking at 8.1%, and All Other (Managed Basis), which includes former Legacy Franchises, global staff functions, corporate treasury, etc. at 11.3% of revenues. Let’s analyze how these major segments performed.

U.S. Personal Banking grew revenues 10% Y/Y, while operating expenses were flat in the quarter. Credit costs remained high, up 34% Y/Y, resulting in a return on tangible common equity (RoTCE) of 5.5% in Q1 2024.

Services increased revenues by 8% Y/Y, below the 11% increase in operating expenses. Credit costs were traditionally benign, resulting in a RoTCE of 24.1% for the segment in Q1 2024.

Markets recorded a 7% Y/Y slump in revenue, in stark contrast to the 7% increase in operating expenses. Credit costs were higher but manageable, resulting in a 10.4% RoTCE for the segment.

Wealth recorded a 4% decrease in its top line Y/Y, again much worse than the 3% increase in operating expenses. The unimpressive 4.6% RoTCE was aided by provision releases.

Banking was the top-performing segment in Q1 2024, with revenues shooting up 49% Y/Y on strength in investment banking and corporate lending. Operating expenses were remarkably 4% lower, which, together with provision releases, helped the segment’s RoTCE reach 9.9% in the quarter.

All Other (Managed Basis) saw revenues decline by 9% Y/Y, while expenses were 18% higher in Q1 2024. Despite provision releases, the division posted a $457 million loss.

For the bank as a whole, revenues declined 2% Y/Y, while operating expenses were 7% higher. The cost of credit was 20% higher, driven by actual credit losses rather than precautionary reserve build. The bank’s RoTCE came in at 7.6% in Q1 2024 (10.9% in Q1 2023). Meanwhile, tangible book value grew 0.6% quarter-over-quarter to $86.67/share, and earnings per share (EPS) came in at $1.58/share in Q1 2024, down 27.8% Y/Y.

Overall, the revenue and operating expenses momentum observed in Q1 2024 was better than Q4 2023 but well below the bank’s 2024 outlook for 2.5% revenue growth and 4.9% lower expenses. In Q1 2024, $225 million of restructuring charges were incurred, which partially explains the weak performance on the expense side. On a positive note, the bank maintained its full-year outlook, implying a significant pickup in operating momentum expected for the rest of the year.

Citigroup’s Capital Position Strengthened. More Buybacks Likely

Citigroup strengthened its capital position in Q1 2024. Its CET1 ratio (which looks at a bank’s capital relative to assets) improved to 13.5% at the end of the quarter, up 0.1% Q/Q, as the bank only distributed 48% of the net income generated during the quarter to shareholders. The 13.5% CET1 ratio represents a 1.2% buffer relative to the 12.3% regulatory requirement.

The strong capital position allows the bank to continue with value-creative share buybacks (in light of the tangible book discount of around 28%), which will be evaluated on a quarter-by-quarter basis. In Q1 2024, the bank allocated $500 million for buybacks or about 16% of its net income attributable to common shareholders.

How Does Citigroup Compare to JPMorgan?

One way to estimate the fair value of Citigroup is to compare it with peers such as JPMorgan Chase (NYSE:JPM). JPMorgan has consistently delivered high profitability, making it a benchmark in the U.S. banking industry. Over 2023 and 2022, JPMorgan delivered RoTCE figures of 19% and 18%, respectively. In Q1 2024, JPMorgan achieved a stellar RoTCE of 21%, partially helped by provision releases. The stock currently trades at a heavy premium to tangible book value, about 2.07x, to be precise.

If we look at Citigroup, with its 0.69x price-to-tangible book ratio, 7.6% RoTCE, and 13.5% CET1 ratio, you may appear indifferent between Citigroup and JPMorgan. Citigroup delivers roughly three times lower profitability and has a three times lower tangible book valuation. However, odds are Citigroup will manage to improve its profitability going forward, benefiting from restructuring, asset sales, and business streamlining, while JPMorgan is likely to see lower profitability as a result of normalizing credit costs.

Consequently, I still think Citigroup is the better pick of the two banks, notwithstanding the risk that the whole sector suffers a correction. In essence, Citigroup may appear cheap but could still get dragged down along with the rest of the banking sector if valuations take a hit across the board.

Is Citigroup Stock a Buy, According to Analysts?

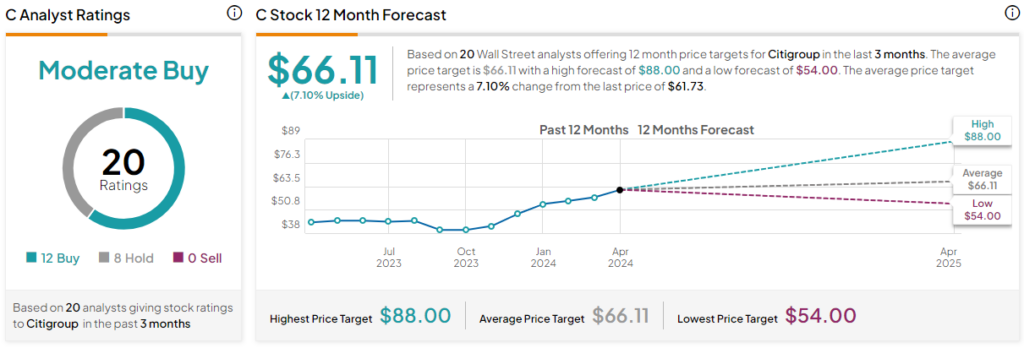

Turning to Wall Street, Citigroup earns a Moderate Buy consensus rating based on 12 Buys, eight Holds, and zero Sell ratings assigned in the past three months. Additionally, Citigroup stock’s average price target is $66.11, implying 7.1% upside potential.

The Takeaway

Citigroup showed improved operating momentum compared to Q4 2023, although on a year-over-year basis, revenue growth came in at negative 2%. Nonetheless, the bank kept its 2024 forecast, implying a significant pickup in operational performance, with higher revenues and lower expenses implied for the remainder of the year.

If you look at Citigroup purely on its current operating results, it appears fairly valued versus peers such as JPMorgan. However, the prospects for the two banks are quite different, with Citigroup expected to benefit from restructuring activities and business sales. As a result, I reckon the shares are worth buying, even after the strong performance year-to-date.

If you’re more risk-averse, selling covered calls can be a good way to hedge some of the recent gains if you want to limit your banking sector exposure as a whole.