Tech company Cisco Systems (CSCO) is set to announce its Q4 results on August 14. Wall Street analysts expect the company to report earnings of $0.85 per share for Q4 2024, down 25% year-over-year. At the same time, analysts expect revenues of $13.53 billion, lower than the year-ago figure of $15.2 billion, according to TipRanks’ data.

In terms of stock price, the company’s shares have fallen about 8% this year. The decline can be attributed to weak networking sales stemming from low demand from telecom and cable service providers.

Nevertheless, it’s important to highlight that the company has surpassed the consensus EPS estimates in all of the last nine quarters.

Layoffs Expected with Q4 Results

Just last week, Reuters reported that Cisco plans to announce another round of layoffs. It is part of Cisco’s efforts to focus on areas like cybersecurity and AI. The announcement is expected to come with Cisco’s fourth-quarter results.

Insights from TipRanks’ Bulls & Bears Tool

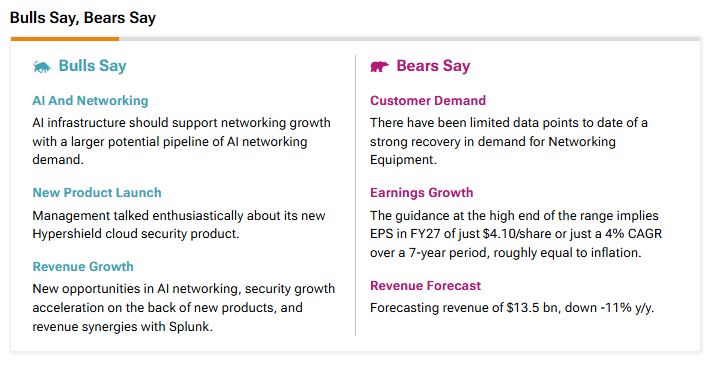

According to TipRanks’ Bulls Say, Bears Say tool pictured below, analysts expect revenues to decline in the upcoming quarter. They anticipate a modest increase in earnings moving forward. Further, analysts remain concerned about Cisco’s outlook, noting a lack of strong evidence for a recovery in networking equipment demand.

It’s also important to consider the bullish arguments. The bulls are optimistic about Cisco’s future, noting that AI infrastructure could drive networking growth and boost demand. They highlight the recently launched Hypershield cloud security product, which strengthens Cisco’s security portfolio. Additionally, they anticipate accelerated revenue growth through AI networking opportunities, improved security, and synergies with Splunk.

Options Traders Anticipate a Minor Move

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting a 6.58% move in either direction.

Is Cisco Stock a Buy, Sell, or Hold?

Turning to Wall Street, analysts have a Moderate Buy consensus rating on CSCO stock based on six Buys and 11 Holds assigned in the past three months, as indicated by the graphic below. Meanwhile, the average price CSCO target of $55.07 per share implies a 21.11% upside potential.