Shares in Cisco Systems Inc. (CSCO) rose after its third-quarter profit topped market expectations as work-at-home orders drove demand for its tools and virtual networking products. The stock appreciated 2.3% to $42.93 in pre-market trading on Thursday.

In the third quarter ended April 25, earnings per share, excluding items, stood at 79 cents exceeding analyst expectations of 69 cents. Total revenue in the reported quarter dropped 8% to $12 billion year-on-year which is slightly higher than the analysts’ average estimate of $11.7 billion.

“The pandemic has driven organizations across the globe to digitize their operations and support remote workforces at a faster speed and greater scale than ever before,” said Chuck Robbins, chairman and CEO of Cisco. “We remain focused on providing the technology and solutions our customers need to accelerate their digital organizations.”

Looking into the fourth quarter, Cisco guided investors by saying that it sees revenue decline between 8.5%-11.5% year-on-year. It also provided financial guidance for adjusted earnings per share of 72 cents-74 cents versus a consensus of 71 cents.

Commenting on the earnings results, five-star analyst Jonathan Ruykhaver at Robert W. Baird, said that in spite of persistent macroeconomic headwinds due to the coronavirus pandemic, Cisco executed well against muted expectations showing nice profit upside.

“Cisco has been giving away free licenses for many of its security products that help enable remote work, including Umbrella, Duo, AnyConnect, and AMP,” Ruykhaver wrote in a note to investors. “We do see an opportunity for Cisco to convert some of these free licenses into paying users as we move through the current crisis, helping to drive growth.”

Ruykhaver raised Cisco’s price target to $48 from $46 and maintained a Buy rating on the stock.

However, Ruykhaver still expects the company’s growth to remain pressured in the near term, with product revenue weighed down by “continued weakness in infrastructure platforms”.

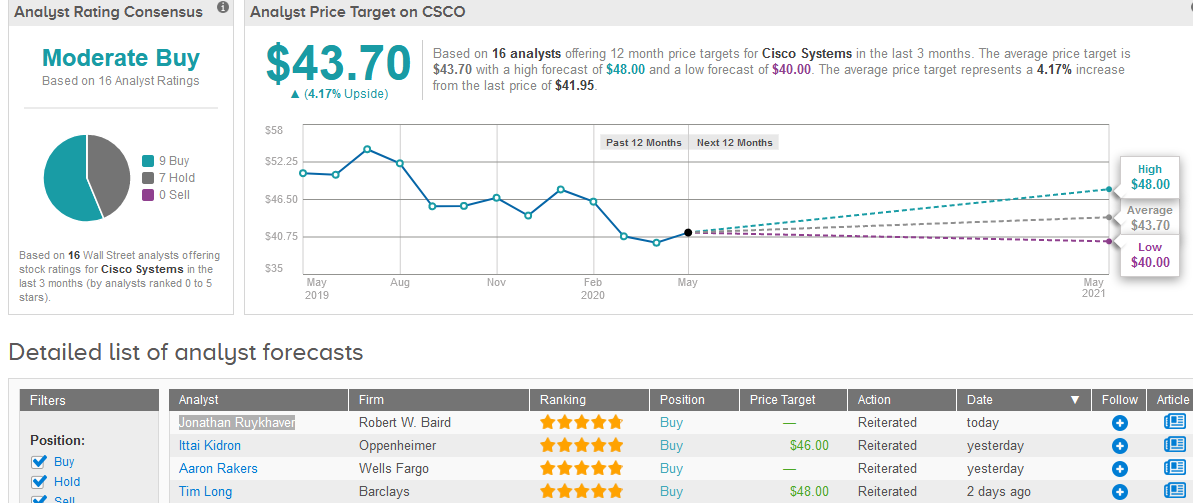

Overall, out of the 16 Wall Street analysts covering the stock 9 have Buys and 7 have Holds adding up to a Moderate Buy consensus. The $43.70 average price target implies 4.2% upside potential in the coming 12 months. (See Cisco’s stock analysis on TipRanks).

Related News:

Tower Semiconductor Reports Q1 Earnings Beat; Top Analyst Says Buy On Weakness

Intelsat Sinks 18% On Bankruptcy Filing

Intel, Taiwan Semiconductor Said to Be in Talks with Trump to Build U.S. Plants