Cisco Systems (NASDAQ: CSCO) has reported upbeat results for the second quarter of Fiscal Year 2022, topping both earnings and revenue expectations.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

Following the news, shares of the manufacturer of networking hardware, software, telecommunications equipment, and other high-technology services and products rose 3.5% in Wednesday’s extended trading session.

Results in Detail

Cisco reported adjusted second-quarter earnings of $0.84 per share, up 6% year-over-year. Further, the figure surpassed the consensus estimate of $0.81 per share.

Revenues of $12.7 billion topped analysts’ expectations of $12.65 billion and surged 6% year-over-year on the back of strong performance across the business. Annualized Recurring Revenue (ARR) stood at $21.9 billion, up 11%.

Segment-wise, product revenue was up 9% year-over-year to $9.4 billion, while service revenue declined 1% to $3.4 billion.

Markedly, product revenue performance was driven by growth in Secure, Agile Networks (up 7%), Internet for the Future (up 42%), End-to-End Security (up 7%), and Optimized Application Experiences (up 12%). However, revenues of Hybrid Work were down 9%.

Adjusted gross margin was 65.5% in the quarter, down 140 basis points year-over-year. Remaining Performance Obligations (RPO) came in at $30.5 billion, up 8%.

CEO’s Comments

The CEO of Cisco, Chuck Robbins, commented, “We continue to see incredibly strong demand across our portfolio, emphasizing the criticality and relevance of Cisco’s innovation. Our robust order strength, record backlog and double-digit growth in annual recurring revenue position us well to deliver growth.”

Guidance

For the third quarter of Fiscal Year 2022, revenue is expected to reflect 3%-5% year-over-year growth. Adjusted EPS is projected in the range of $0.85 to $0.87 against analysts’ expectations of $0.86 per share.

For Fiscal Year 2022, revenue is likely to reflect 5.5%-6.5% year-over-year growth. Adjusted EPS is anticipated between $3.41 and $3.46, as compared to the consensus estimate of $3.42 per share.

Capital Deployment

Cisco has announced a quarterly common stock dividend of $0.38 per share, up 3% over the prior quarter’s dividend. The new dividend will be paid on April 27, 2022, to all stockholders of record as of April 6, 2022.

Cisco’s board of directors has increased the share repurchase authorization by $15 billion. The remaining stock repurchase authorization, including the additional amount, stands at $18 billion.

Wall Street’s Take

The rest of the Street is cautiously optimistic about the stock and has a Moderate Buy consensus rating based on 11 Buys versus 8 Holds. The average Cisco price target of $65.73 implies 21.16% upside potential to current levels. Shares have increased 22.7% over the past year.

Risk Analysis

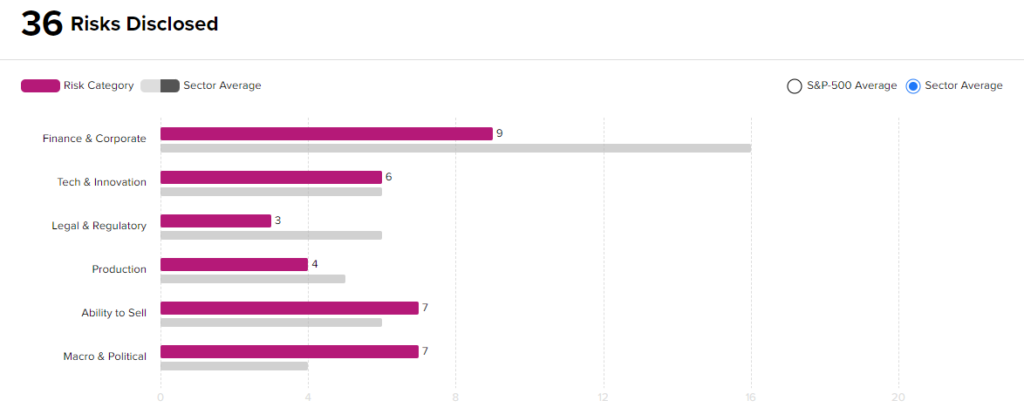

According to the TipRanks Risk Factors tool, Cisco stock is at risk mainly from three factors: Finance and Corporate, Ability to Sell, and Macro & Political, which contribute 9, 7, and 7 risks, respectively, to the total 36 risks identified for the stock.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Virgin Galactic Pops 32% After Offering Future Spaceflight Reservation

ContextLogic Introduces ‘Wish Clips’ Feature; Shares Jump Over 18%

Toast Posts Greater-than-Expected Q4 Loss; Shares Decline Over 15%