Cisco (CSCO) has announced its intent to acquire privately held BabbleLabs, to help users control unwanted noise in meetings.

BabbleLabs uses advanced AI techniques to distinguish human speech from unwanted noise, enhancing the quality of communications and conferencing applications.

According to Cisco, BabbleLabs goes beyond existing solutions by distinguishing speech from background noise; removing background noise in real-time; and enhancing the voice to elevate communication, regardless of language.

Indeed, Cisco’s survey showed that 98% of workers experience frustration from distractions during video meetings when working from home. Two of the top 5 frustrations called out are about background noise.

With BabbleLabs, Cisco says it will bring native noise removal capability to its entire Collaboration portfolio, although first it will focus on bringing BabbleLabs to Webex Meetings.

The acquisition is expected to close in the first quarter of Cisco’s FY21, subject to customary closing conditions and regulatory approvals. Upon completion, the BabbleLabs team will join the Cisco Collaboration Group, which is part of the Cisco Security and Applications Business.

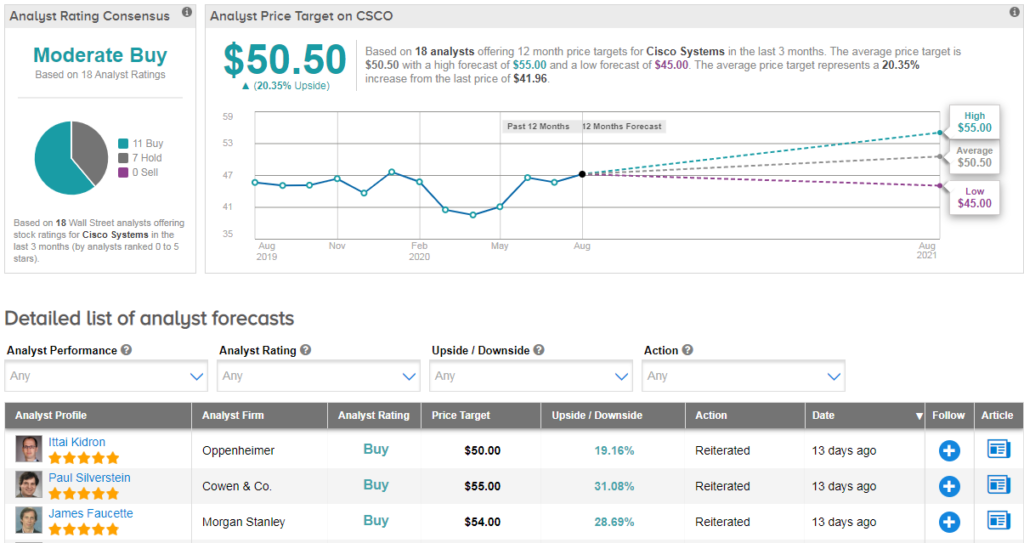

Shares in Cisco have dropped 12% year-to-date, and analysts have a cautiously optimistic Moderate Buy consensus on the stock’s outlook. That’s with a $50.50 average analyst price target, indicating 20% upside potential from current levels.

Oppenheimer analyst Ittai Kidron recently reiterated his Cisco buy rating with a $50 price target. He made the call after Cisco reported 4QFY20 results that came slightly ahead of the Street; however, guidance for 1QFY21 was below consensus.

“COVID-19 has made for a challenging spending environment, yet it has also caught Cisco unprepared for an acceleration in the shift to cloud/ work-from-home” the analyst commented. Specifically, legacy portions of Cisco’s portfolio are under pressure (VoIP, DC) whereas growth areas (Webex, AppDynamics) remain too small and face competitive challenges.

According to Kidron, a more aggressive M&A approach is needed to address product gaps. “What keeps us engaged is Cisco’s aggressive cost-cutting measures, software/subscription traction, strong BS ($11.8B), and easier upcoming comps” the analyst concluded. (See CSCO stock analysis on TipRanks).

Related News:

Salesforce Spikes 13% In After-Hours On Lifted Sales Guidance

Northland Cuts AMD To Hold Due To ‘Negative’ Catalysts

Palo Alto Beats 4Q Estimates Spurred By Remote Working Trend