Cineworld (GB:CINE) shares plunged as the cinema chain revealed that it was considering options including diluting shares, in the wake of disappointing post-pandemic ticket sales.

Don't Miss Our Christmas Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The chain blamed a lack of blockbuster films in recent months, and shares fell as low as 7.77p in the wake of the news.

The company said it is in “active discussions with various stakeholders and is evaluating various strategic options to both obtain additional liquidity and potentially restructure its balance sheet through a comprehensive deleveraging transaction.”

Analysts at Peel Hunt said, “It is not clear whether Cineworld will be able to raise fresh debt or issue fresh equity but, in either case, it appears that the value of the existing equity will be further diluted.”

Hollywood has released fewer blockbuster films this year, after COVID restrictions disrupted production on several major films.

Cineworld stock and a ‘limited film slate’

Cineworld’s update stated: “Despite a gradual recovery of demand since re-opening in April 2021, recent admission levels have been below expectations. These lower levels of admissions are due to a limited film slate that is anticipated to continue until November 2022.”

The dismal forecast saw shares trading around 8p in the wake of the news, 97% lower than 2019 levels.

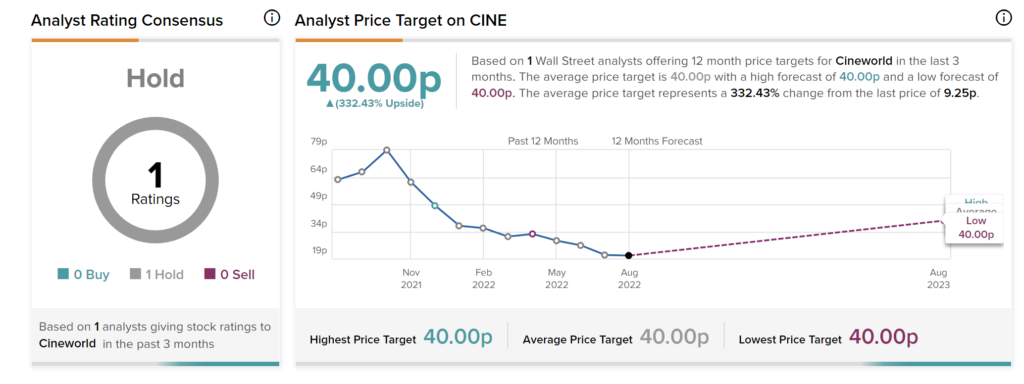

Prior to the update, according to TipRanks’ analyst rating consensus, Cineworld stock had a Hold rating, based on one Hold rating.

The average price target was 40p.

What’s happening with Cineworld?

Cineworld’s current position looks extremely bleak, although in the longer term a recovery in the broader sector is expected.