Ciena Corporation (CIEN), a networking equipment and software services company, reported better-than-expected quarterly results driven by strong order flow and increased backlog. Shares jumped 7.3% to close at $58.38 on June 3.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The company reported adjusted earnings of $0.62 per share in fiscal Q2, down 18.4% from the prior-year period. However, earnings outpaced the Street’s estimates of $0.48 per share.

Adjusted revenue for the quarter declined 6.7% year-over-year to $833.9 million but beat analysts’ estimates of $829.27 million.

Compared to the year-ago period, total Networking Platforms revenue declined 11.3% to $637.3 million, while total Global services revenue remained flat at $116 million. (See Ciena stock analysis on TipRanks)

Gary Smith, President and CEO of the company said, “We delivered strong fiscal second quarter results as we continued to see encouraging signs in the market environment, including improvements in customer spending. These dynamics, combined with our business and financial performance in the first half of the year, give us strong visibility and confidence in our ability to achieve our financial targets as we move through the year.”

In the fiscal third quarter, the company forecasts revenue to be in the range of $950 – $980 million, compared to the Street’s estimates of $962.3 million. For Fiscal 2021, the company forecasts revenue to grow 0% – 3% year-over-year.

Following the results, Raymond James analyst Simon Leopold lifted the price target on the stock to $64 (from $56) implying 9.6% upside potential to current levels.

Leopold maintained a Buy rating and said, “We remain optimistic regarding CY21/CY22 opportunities, driven by product cycles and demand stabilization/improvement on Ciena’s strongholds. We continue to envision the Huawei backlash as a long-term opportunity to materially expand share in Europe.”

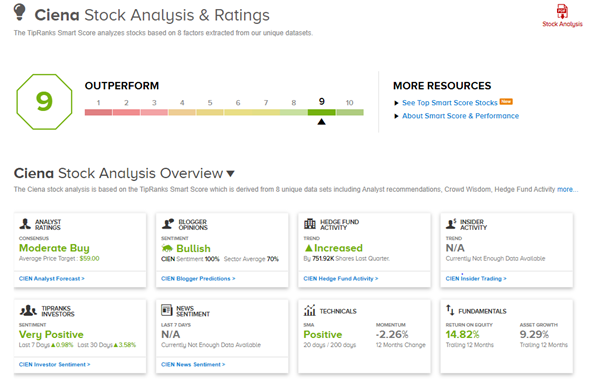

The rest of the Street is cautiously optimistic about the stock with a Moderate Buy consensus rating based on 9 Buys and 4 Holds. The average analyst price target of $59 implies 1.1% upside potential to current levels. Shares have gained 24.3% over the past six months.

Ciena scores a 9 of 10 from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Related News:

Guidewire Reports Q3 Loss, Revenues Beat Expectations

Elastic Posts Smaller-than-Expected Quarterly Loss; Shares Pop 13% After-Hours

Semtech Reports Robust Q1 Results, Beats Expectations