Earlier today, the Canadian Imperial Bank of Commerce (TSE:CM) (NYSE:CM), also known as CIBC, reported its Fiscal Q3-2023 financial results, which slightly beat revenue expectations but missed earnings-per-share (EPS) forecasts by a noticeable margin. As a result, the stock is down for the day.

In Q3, CIBC’s revenue rose by 5% to C$5.85 billion compared to the consensus estimate of about C$5.8 billion. However, adjusted earnings per share were C$1.52, missing the C$1.68 consensus estimate and down 17.8% from the C$1.85 per share recorded in the same period last year. For reference, Bank of Montreal (TSE:BMO) (NYSE:BMO) and Bank of Nova Scotia (TSE:BNS) (NYSE:BNS) also reported earnings recently, with their diluted earnings per share falling by 10% and 17.6%, respectively.

Further, CIBC’s adjusted return on equity fell to 11.9% from 15.1% last year, and its CET1 ratio (a liquidity ratio — a higher percentage indicates more liquidity) increased by 40 basis points year-over-year to 12.2%.

Now, let’s look at the bank’s individual segments. Its Canadian Personal and Business Banking segment experienced headwinds, with net income falling 16% year-over-year to C$497 million, mostly because of “higher provision for credit losses and lower card fees.”

Notably, U.S. Commercial Banking and Wealth Management saw a large 64% drop in profits to C$73 million. Meanwhile, CIBC’s Canadian Commercial Banking and Wealth Management experienced a net income decrease of just 4% to C$467 million.

Is CM a Good Stock to Buy Now?

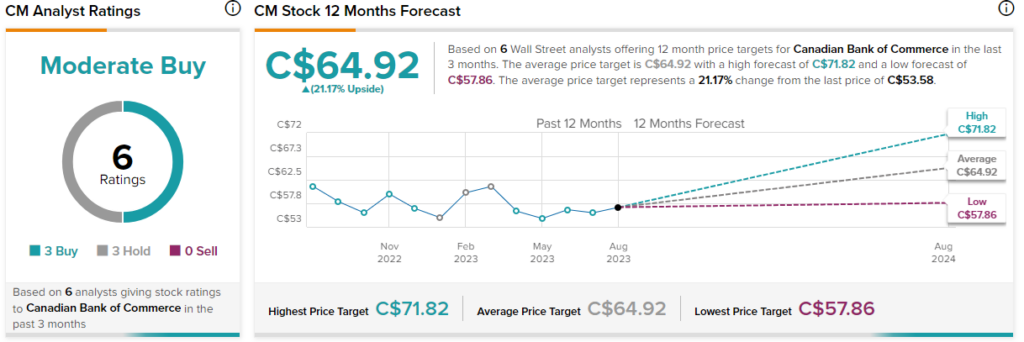

According to analysts, CM stock comes in as a Hold based on three Buys and three Holds given in the past three months. The average CM stock price target of C$64.92 implies 21.2% upside potential.