The volatility of the electric vehicle stocks has officially spread to its charging infrastructure. With Tesla (NASDAQ:TSLA) increasingly enjoying its new status as the standard, that’s leaving several other electric vehicle charging stocks such as ChargePoint Holdings (NASDAQ:CHPT), Wallbox (NASDAQ:WBX), Blink Charging (NASDAQ:BLNK), and Evgo (NASDAQ:EVGO) out in the cold. All four of these were down in Tuesday afternoon’s trading, though the extent varied. The Tesla Supercharger network recently won another convert, as Rivian (NASDAQ:RIVN) announced that it would set up its own vehicles to access said network.

By Spring 2024, Rivian noted, its customers should be able to access the roughly 12,000-strong network of Tesla Supercharger stations out there. Meanwhile, Hyundai (OTHEROTC:HYMTF) also noted that it would look into making its vehicles more compatible with Tesla stations.

Admittedly, this is likely the smartest move. Electric vehicles do not have the benefit of gas-powered vehicles and their nearly-universal fuel sources. Gas stations can be found even in the smallest of towns today, with most any city large enough to command the presence of a Burger King containing two or more. Electric vehicles need to have ubiquitous, widely-available recharge points, and “this one doesn’t work with my car” likely won’t cut it. With a growing range of cars working with the North American Charging Standard—increasingly the Tesla Charging Standard—that’s going to help settle that one sticking point. Granted, that will hurt every other charger maker out there, but it’s a necessary impact at this point.

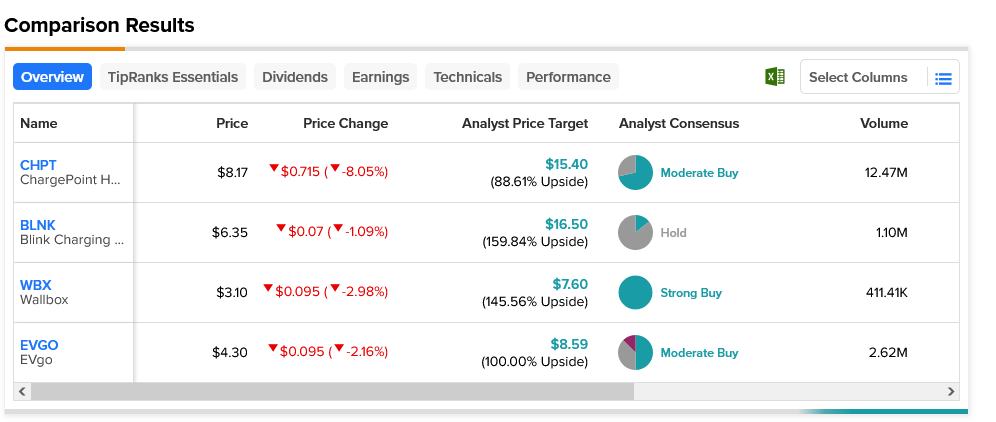

ChargePoint stock was hit the hardest today, and it also has the least upside potential. It has a Moderate Buy rating with an average price target of $15.40, offering investors 88.61% upside potential. Meanwhile, Blink Charging, hit the least, offers the best upside. Rated as a Hold by analyst consensus, it also boasts an upside potential of 159.84% thanks to its average price target of $16.50.