The fast-food restaurant chain Chipotle (CMG) has endured a sharp correction since its stock split, with shares down by more than 25% since June 18. Despite the correction, Chipotle’s fundamentals remain strong, with growing profit margins, expanding operations, and rising comparable sales, prompting me to be bullish on the stock. In my opinion, GRMN presents a long-term opportunity for investors.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Chipotle Is Still Growing

The first reason supporting my bullish view is Chipotle’s consistent revenue growth, which highlights the company’s ability to thrive even during a stock pullback.

In the second quarter, Chipotle reported 18.3% year-over-year revenue growth, reaching $3.0 billion in sales. Several factors have driven Chipotle’s ongoing revenue expansion. Firstly, the company has consistently increased its number of locations, opening 52 new restaurants, 46 of which feature a Chipotlane. To clarify, a Chipotlane is a drive-thru service window where customers can pick up their orders without leaving their cars.

Additionally, Chipotle has launched an international licensed restaurant, broadening its reach. Further, while Chipotle hasn’t yet tapped into franchises, it has a promising opportunity for expansion in international markets. Plus, existing restaurants reported a notable 11.1% increase in comparable sales, showcasing robust demand.

Established Competitors Are Slowing Down

Another reason Chipotle presents a solid investment opportunity is its competitive advantage, particularly when its peers are struggling.

Fast-food giants like McDonald’s (MCD), Starbucks (SBUX), and Wendy’s (WEN) have experienced flat or declining revenue due to inflationary pressures, while Chipotle continues to thrive. Its focus on health-conscious consumers has helped it retain customers despite rising prices.

As more people choose Chipotle and other fast-food options that emphasize health, established competitors may continue to lose market share.

Earnings Trends Will Aid the Valuation

Chipotle’s earnings trajectory further strengthens its investment case, as the company’s profitability continues to improve despite the stock’s high valuation.

The main weakness of Chipotle stock has been its valuation, but investors usually have to pay a rich price to access the best companies. Chipotle isn’t trading at as high of a premium due to the 20% drop after the stock split.

Importantly, the fast food restaurant chain still trades at a 55 P/E ratio, but meaningful net income growth should make the valuation more manageable over time. Chipotle reported 33% year-over-year net income growth to reach $455.7 million in the second quarter. Rising profits reduce the P/E ratio, and any further corrections will sweeten the valuation. Granted, a high P/E ratio hasn’t scared investors, as the stock has more than tripled over the past five years.

Investors focused on long-term growth should find this combination of rising earnings and improved valuation appealing.

Niccol’s Departure Doesn’t Change the Long-Term Catalyst

Leadership changes often trigger short-term volatility, but Chipotle’s long-term growth potential remains intact despite CEO Brian Niccol’s departure.

Although Chipotle’s stock fell following Brian Niccol’s departure as investors questioned the company’s ability to thrive without his leadership, Niccol significantly contributed to its growth over the years. Nevertheless, Chipotle has a well-established roadmap and continues to provide high-quality service.

With more than 3,500 restaurants as of June 30, 2024, Chipotle looks like it can fulfill its long-term goal of operating 7,000 restaurants in North America. This vision would result in solid returns for long-term investors.

Niccol’s leadership has helped create tailwinds that Chipotle will continue to enjoy. Customers are still flocking to the company’s locations, and the company is known as a top choice for health-conscious consumers. His departure created a dramatic reaction from the stock market that has only amplified the short-term pullback, creating a favorable opportunity for long-term investors.

Is Chipotle Stock a Buy?

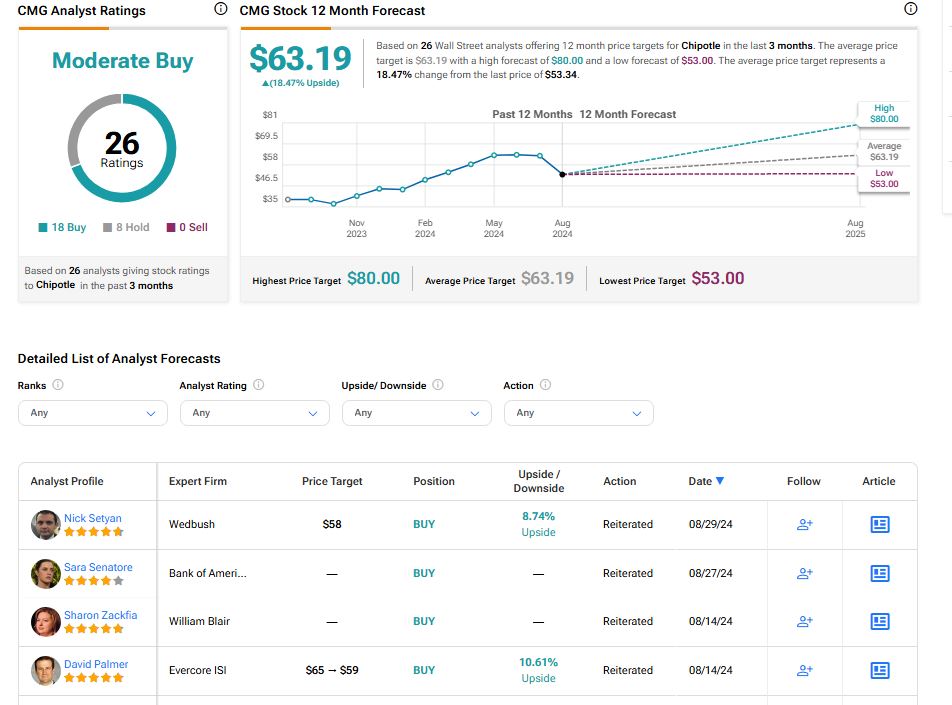

Chipotle is rated as a Moderate Buy based on 18 Buy ratings and eight Hold ratings assigned in the past three months, as indicated by the graphic below. The average CMG price target of $63.19 per share implies 18.47% upside potential.

The Bottom Line on Chipotle Stock

The recent pullback in Chipotle stock is temporary and presents a long-term buying opportunity, despite short-term fluctuations. The company has been resilient during this inflationary environment, while competitors have been ceding market share.

Chipotle has more than 3,500 locations that average an 11.1% year-over-year increase in comparable sales. Not only is the company retaining customers, but it also continues to grow at a fast pace, adding 52 restaurants in the second quarter.

It’s normal for stocks to correct if investors believe the valuation has become too high. Chipotle’s impressive momentum leading up to the stock split made its valuation vulnerable. However, the already reduced valuation plus high net income growth suggests that Chipotle can reward patient investors at current levels.

Given these factors and the company’s strong operational performance, Chipotle appears well-positioned for future growth. The current stock price presents a compelling entry point for long-term investors. Therefore, I am bullish on CMG stock.