Chinese electric vehicle (EV) producer XPeng (XPEV) crashed today amid an ongoing Chinese market selloff. After a month of mostly trending upward, XPEV stock reversed course on Friday, October 11. So far this week, it has only declined further as the Chinese selloff continues.

What Is Happening with XPEV Stock?

Over the past six months, XPEV stock has risen 60%. So, what’s causing the selloff across multiple Chinese sectors? The nation’s financial markets seem to have entered a correction period after last month’s rally. When China’s government announced plans for an aggressive stimulus package on September 24, it generated significant momentum. Indeed, the CSI 300 Index surged on the news in late September but has fallen 11% over the past week. Now, it seems that investors have decided to cash out from the previous rally.

More recently, The Chinese government provided further details on its fiscal stimulus plans. However, Reuters reported that it has left out key details, such as the overall size of the package. This has left investors to guess as to its overall impact, sparking uncertainty across many Chinese sectors.

XPeng isn’t the only Chinese stock to be negatively impacted by this trend. Fellow Chinese automaker Nio (NIO) fell over 7% today, while tech conglomerate Baidu (BIDU) dropped by more than 4%. While the CSI 300 is still in the green, its performance throughout the day has been volatile.

Is XPEV Stock a Buy, Sell, or Hold?

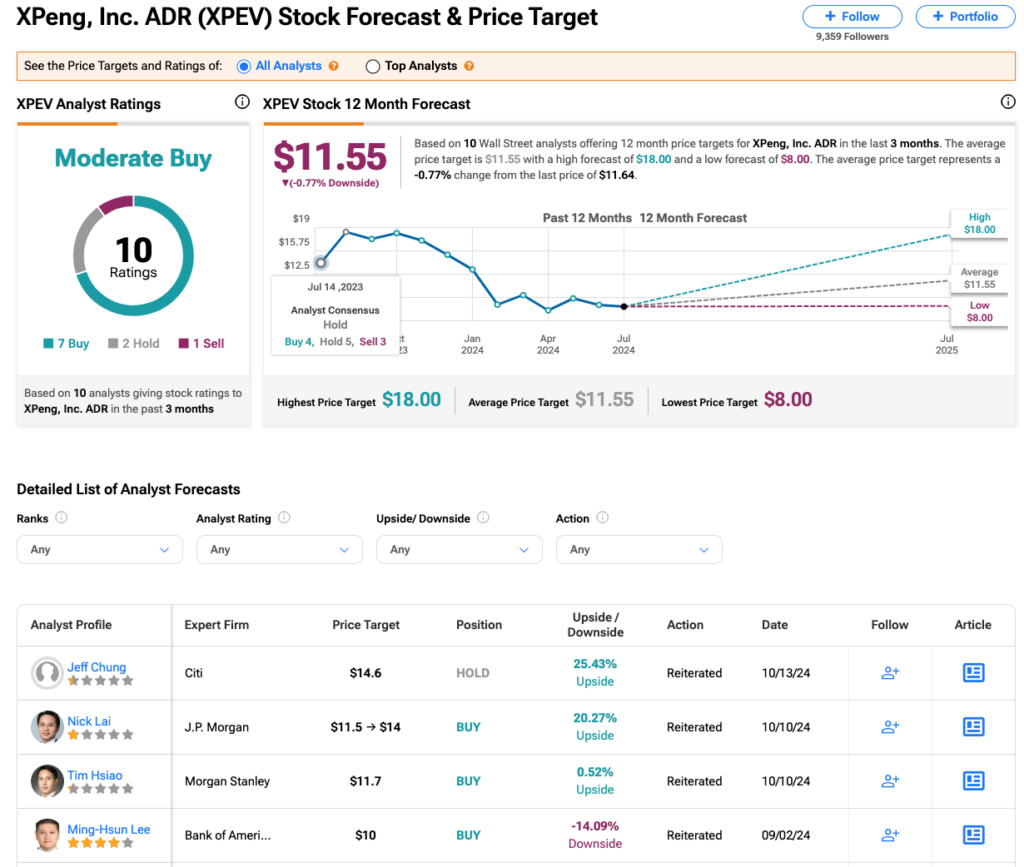

Despite today’s performance, Wall Street remains primarily bullish on XPeng. Analysts have a Moderate Buy consensus rating on XPEV stock based on seven Buys, two Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 30% rally over the past month, the average XPEV price target of $11.55 per share implies 0.8% downside potential.

Companies like XPeng and Nio could also be under pressure from the recent tariffs imposed by the European Union (EU) against Chinese EVs. However, Wall Street analysts are overall optimistic that this negative momentum will not continue, at least not against XPEV. In September 2024, the company reported strong year-over-year growth, with both revenue and vehicle deliveries increasing.