Chinese EV manufacturers, including XPeng (XPEV), Li Auto (LI), and NIO (NIO), continued to roar ahead in January with their monthly vehicle deliveries. These companies are giving strong competition to EV giant Tesla (TSLA) in China. As a result, LI, NIO, and XPEV were trading higher on Thursday.

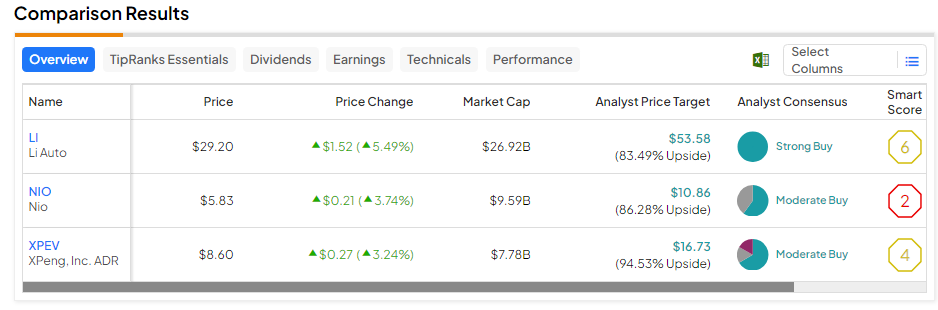

Overall, while analysts remain bullish on LI and XPeng with Strong Buy consensus ratings, they are cautiously optimistic about NIO with a Moderate Buy rating. XPeng offers the highest upside potential of 94.5% at current levels, as the average XPEV price target is $16.73.

XPeng’s January Deliveries Soar By 58%

XPeng’s monthly deliveries shot up 58% year-over-year to 8,250 vehicles in January. The company also launched an X9 Ultra Smart Large Seven-seater Multipurpose Vehicle (MPV) last month, which was immediately delivered across more than 100 cities in China.

The company’s X9 Max Trim comprised around 70% of the total X9 orders, and its Advanced Driver Assistance System (ADAS) technology, XNGP, now has a monthly active user penetration rate of more than 85%. Moreover, the company plans to expand the coverage of XNGP to urban roads and parking by 2024.

NIO Powers Ahead with Record Deliveries

NIO’s vehicle deliveries surged by 18.2% year-over-year to 10,055 vehicles in January, with cumulative deliveries of its vehicles reaching 459,649 as of January 31. The company’s deliveries consisted of 6,307 premium smart electric SUVs and 3,748 premium smart electric sedans.

In addition, the EV major has opened up its battery swap network to the entire EV industry. In January, the company partnered with JAC Group and Chery Automobile for battery swapping. NIO has also co-founded Zhongan Energy with other investors for a shared battery charging and swapping network and aims to build 1,000 swap stations in China.

Li Auto’s Deliveries Surge in January

Li Auto had a blockbuster start to the new year, as its EV deliveries skyrocketed by 105.8% year-over-year to 31,165 vehicles in January. The company’s cumulative deliveries reached 664,529 at the end of January. The company is launching the Li MEGA MPV in March and continues to invest in R&D for autonomous driving.

Li Auto plans to expand its retail stores to over 800 by the end of this year and is targeting 800,000 deliveries this year. Moreover, the company stated that during the Chinese New Year holiday, from February 9 to February 17, all 330 of its supercharging stations will offer free charging for Li Auto users.

Is DRIV a Good Buy?

The Global X Autonomous & Electric Vehicles ETF (DRIV) is a good option for investors interested in getting exposure to the EV sector. Even as DRIV declined by more than 6% over the past year, analysts remain cautiously optimistic with a Moderate Buy consensus rating based on 49 Buys, 26 Holds, and two Sells. The average DRIV price target of $28.82 implies an upside potential of 26.8% at current levels.