ByteDance, the Chinese internet technology company that owns TikTok, continues to use chipmaker Nvidia’s (NVDA) advanced AI chips. This is despite U.S. export restrictions that are in place to limit China’s access to such technology. In fact, according to The Information, the company plans to spend up to $7 billion in 2025 to secure Nvidia chips through overseas cloud services, which would circumvent the restrictions by operating data centers outside of China.

Overall, the company will allocate over $20 billion next year for AI-related hardware such as chips, data centers, and undersea cables. ByteDance wants to build its own AI models, like the Doubao chatbot app with 60 million monthly users, and scale its AI operations internationally. In addition, ByteDance’s founder, Zhang Yiming, has been directly involved in negotiating with suppliers and data center operators in Southeast Asia and Europe in order to make sure there is enough infrastructure to support these initiatives.

Concerns about Nvidia Sales

Interestingly, in a separate report from last week, some investors were concerned that Nvidia’s sales may be potentially impacted by two factors:

- DeepSeek’s AI model, which was built with only $5.6 million.

- The potential for stricter regulations on chips that can be sold to China.

However, Nvidia stock is trading higher today as today’s news seems to be reducing the initial stress caused by these issues. Indeed, ByteDance’s plan to invest $7 billion to secure Nvidia chips shows that the demand for large datacenters is still there while also demonstrating that companies can use clever tactics to secure the resources they need despite restrictions.

Is NVDA a Good Stock to Buy?

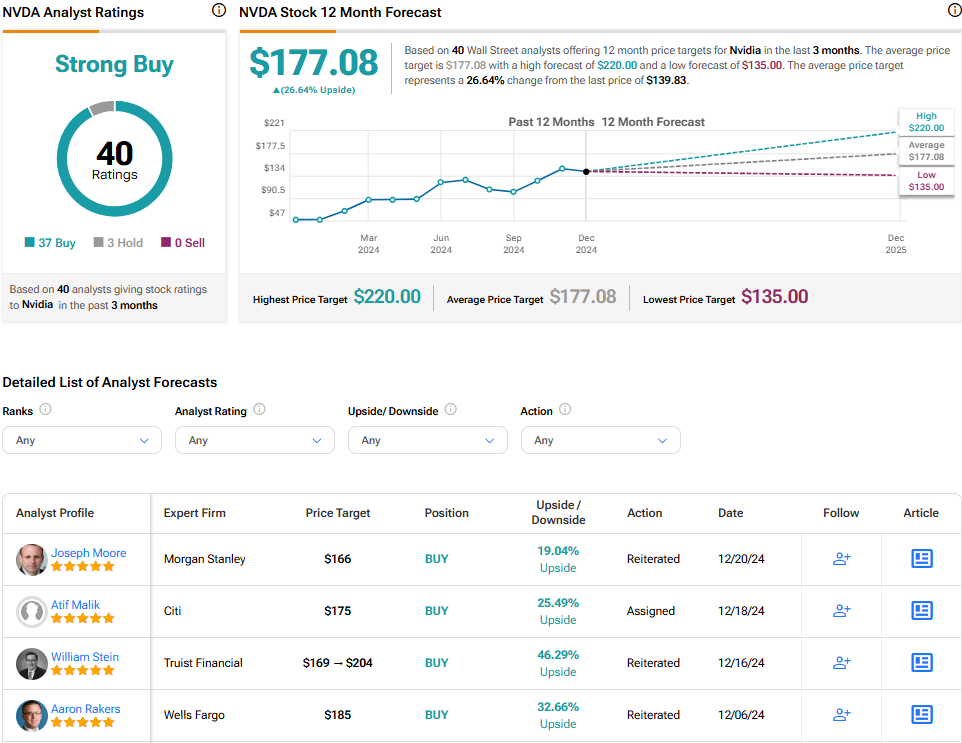

Overall, Wall Street has a Strong Buy consensus rating based on 37 Buys and three Holds assigned in the past three months. After a 190% rally in its share price over the past year, the average NVDA price target of $177.08 per share implies an upside potential of 26.6% from current levels.