Chinese regulators have launched an investigation into Alibaba Group and will meet with its affiliate, Ant Group, in the next few days. This is the latest move in the Chinese government’s attempts to crackdown on anticompetitive behavior in China’s internet space, Reuters reported.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Regulators specifically mentioned Alibaba’s (BABA) “one from two” exclusivity policy in which merchants are prevented from offering their products on rival platforms. Alibaba has defended this policy in the past, which has become an increasing source of friction with regulators.

Last month, regulators dramatically suspended Ant’s planned $37 billion initial public offering just two days before it was meant to go public in Hong Kong and Shanghai. The IPO was on track to become the world’s largest IPO so far.

According to a statement released on Thursday by the People’s Bank of China, the meeting between regulators and Ant Group over the coming days casts further doubt on the potential of reviving Ant’s IPO listing.

Alibaba and Ant have both acknowledged the impending investigations and have committed to complying and co-operating with the regulators.

Alibaba shares fell nearly 9% in Hong Kong on Thurday, hitting their lowest levels since July. The shares were trading 8.5% lower in pre-market U.S. trading at the time of writing. (See BABA stock analysis on TipRanks)

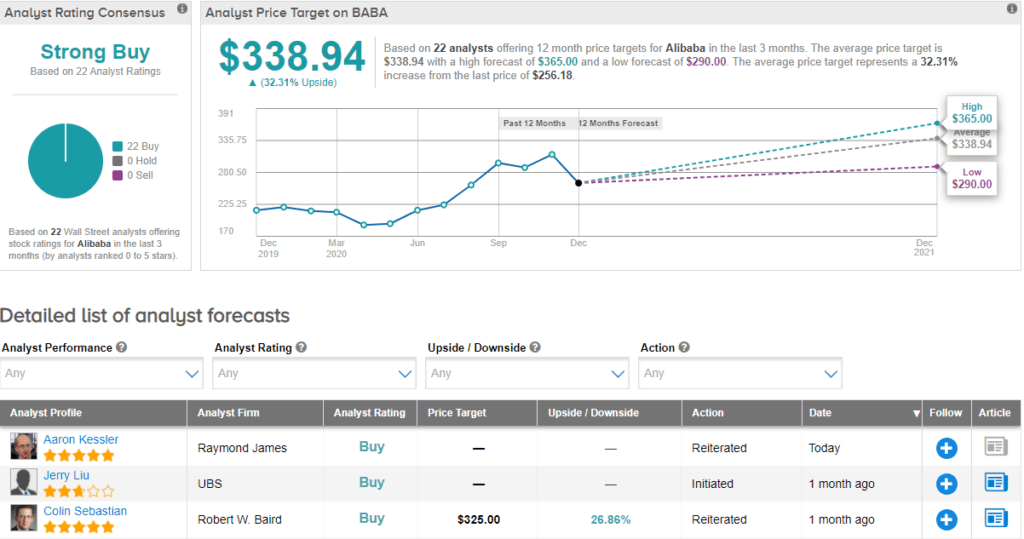

Baird analyst Colin Sebastian reiterated his Buy rating on the stock last month, setting a price target of $325 (27% upside potential). Commenting after the release of Alibaba’s Q2 results, Sebastian specifically highlighted Chinese customers’ increasing demand for interactive content and noted that this trend was slowly moving into Western markets, with Amazon’s Prime Day events hosting a number of live streams and influencer broadcasts.

Consensus among analysts is a Strong Buy, with all 22 analysts who have rated the stock over the past three months offering a Buy rating. The average price target of $338.94 implies upside potential of around 32% over the next 12 months.

Alibaba shares have gained around 20% in value so far this year.

Related News:

Entergy, Holtec File Transfer Request For Palisades Nuclear Plant; Street Sees 21% Upside

Palantir Wins $31.5M U.K. National Health Service Contract

Italian Court Delivers Judgement on Vivendi-Mediaset Dispute – Report