Shares of Chilean lithium major Sociedad Quimica Y Minera de Chile SA (NYSE:SQM) are in focus today after the company entered into a partnership with Codelco. The latter is Chile’s state-owned copper miner. Chile holds the largest lithium reserves globally. Consequently, developments in the country’s lithium space can have far-reaching consequences. The partnership with SQM stands to potentially make Codelco a leading name in the lithium sector as the company gets a majority stake in SQM’s Chilean brine assets.

Last year, the two companies had agreed to jointly develop lithium in the Salar de Atacama. Under the partnership, SQM will be able to operate in the region for three more decades in exchange for giving up its majority stake in the Atacama salt flat.

Chilean Government Wants Higher Ownership of Key Assets

Importantly, the partnership is part of the Chilean government’s strategy of having higher state ownership in key assets and ramping up the production of lithium. Notably, SQM’s contracts for the properties it leases from Chile’s economic development agency are set to expire in 2030. Moreover, the partnership paves the way for new public-private operations in the Atacama region. The strategic move could result in lithium output in the region rising to 300,000 tons from 200,000 tons, according to Bloomberg.

For SQM, the partnership follows its recent disappointing first-quarter performance. The world’s second-biggest lithium miner swung to an $870 million net loss for the quarter as elevated supply weighed on prices. Despite a global lithium supply glut, SQM plans to ramp up its lithium carbonate capacity to 240,000 metric tons annually next year. It also plans to expand its lithium hydroxide capacity to 100,000 metric tons per year from the present 40,000 metric tons.

Meanwhile, China’s Tianqi Lithium, the second-largest investor in SQM, is seeking a shareholder vote over the Codelco deal and has indicated potential legal action, according to Bloomberg.

What Is the Stock Price Forecast for SQM?

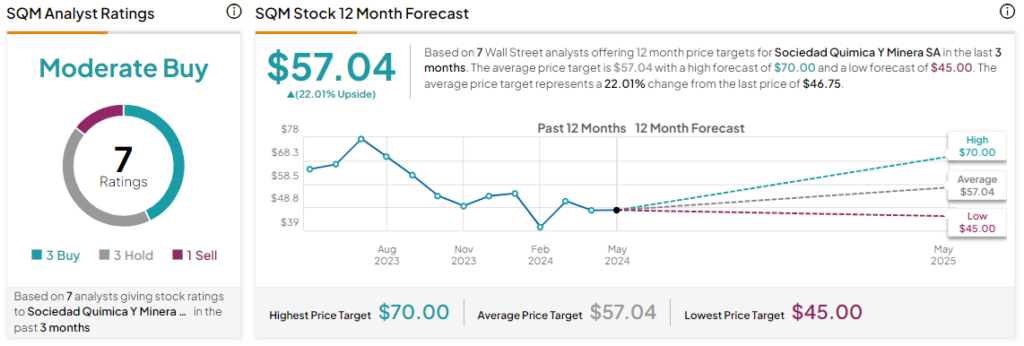

SQM’s stock price has tanked by nearly 25% over the past year. Overall, the Street has a Moderate Buy consensus rating on the stock, alongside an average SQM price target of $57.04.

Read full Disclosure