Shares in Chewy Inc. (CHWY) surged 6% on Wednesday after the pet-ecommerce company announced a new telehealth service called “Connect With a Vet.”

The service will enable pet owners to connect directly with a licensed vet to discuss their pet’s health and receive referrals to local vets or emergency clinics. The vets are not diagnosing medical conditions, providing treatment, or prescribing medications.

During the pilot phase of the “Connect With a Vet” program over 80% of users rated the service 10/10, the company stated.

“We have focused our efforts into developing an easy to use and convenient tele-triage product that we anticipate will have a positive impact given the current environment, and also extend beyond that,” said Sumit Singh, CEO of Chewy.

“Visiting a local vet continues to be a challenge for many pet parents during this time. Similarly, the vet community has also been impacted via clinic shutdowns or reduced clinic hours. So, we thought, why not come up with a solution that can help both communities, our customers and veterinarians, in this time of greatest need” he added.

The “Connect With a Vet” tele-triage service was initially launched in Florida and Massachusetts in May, and Chewy has expanded it to over 35 states with plans of offering it nationwide. The service is currently free and available to subscribers to the company’s Autoship program, which is responsible for nearly 70% of Chewy’s net sales.

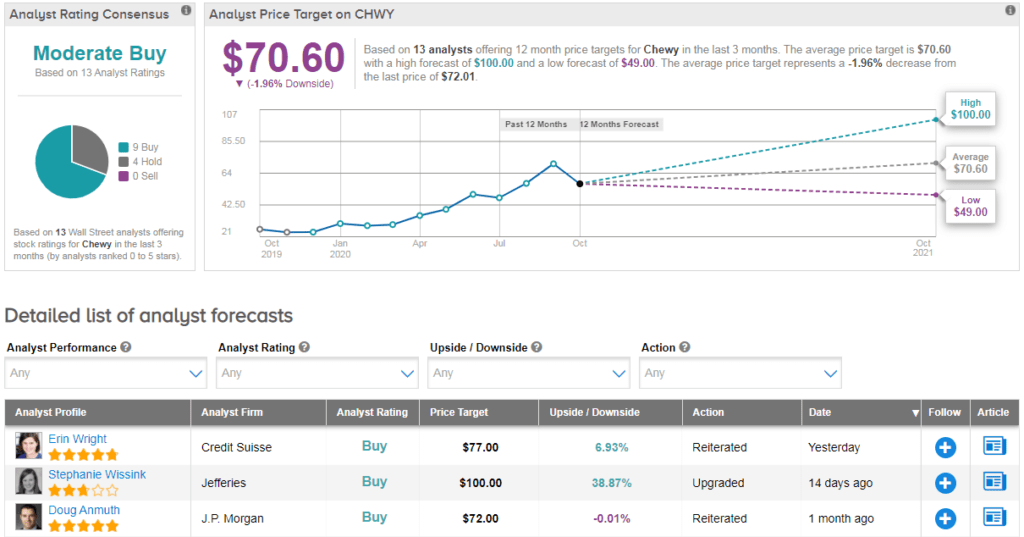

Shares in CHWY have exploded by an incredible 148% year-to-date, and the stock scores a cautiously optimistic Moderate Buy Street consensus. Due to the recent rally the $71 average analyst price target now indicates that shares could pull back from current levels.

“At a high level, CHWY’s TAM remains very large ($100B per APPA), its penetration small (single-digit %), its value proposition very robust (as reflected in our surveys’ very high customer sat scores), its business model strengthening (GM, EBITDA, FCF), and its execution to date very strong” explains RBC Capital analyst Mark Mahaney.

He has a buy rating on the stock and $74 price target, adding that that key differentiators to Chewy’s model include the extremely high-touch customer service, wide product selection, and convenience it offers. (See Chewy stock analysis on TipRanks).

Related News:

Gilead Cuts 2020 Guidance As Remdesivir Sales Disappoint

Boeing Posts Quarterly Loss As Air Travel Halt Dents Sales; Shares Dip

Amazon Hires 100,000 Seasonal Workers Ahead Of Peak Holiday Period