Chewy (CHWY), the pet retailer, has seen its stock lose some ground following a mixed Q3 earnings report released on December 4th. However, my bullish outlook remains intact due to the company’s strong progress toward profitability, backed by its auto-ship model, which ensures inventory stability and makes Chewy a rare example of recurring revenue outside the tech sector. The recent pullback in investor sentiment was mainly due to a decline in gross and adjusted EBITDA margins, driven by product mix rather than operational issues. Despite this, Q3 still demonstrated positive signs of progress, with Chewy’s resilient business model continuing to perform well.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

In this article, I will outline the reasons why I remain bullish on Chewy, what went well, and what didn’t in Q3. Also, I’ll explain why I believe this could be a good opportunity to buy CHWY during its current weakness.

The Main Reason To Like Chewy

One of the key factors behind my bullish thesis on Chewy is its business model, particularly the auto-ship customer sales. With auto-ship, customers tell Chewy to send them pet food every month or every two weeks, and about 80% of Chewy’s total sales come from this model. This makes Chewy a rare example, outside of the tech space, of a company with a recurring revenue model—a business model I find highly valuable.

This recurring revenue model creates a predictable and steady stream of income for Chewy, as the company knows in advance how much product customers will need and when. This allows for better inventory management and more accurate financial forecasting. As a result, it can lead to improved profitability, stronger cash flow, and higher returns on invested capital.

The good news is that in the most recent quarter (Q3), auto-ship customer sales grew by 8.7%, showing a sequential improvement compared to 6.4% in Q1 and 5.8% in Q2. Additionally, Chewy is investing in initiatives like opening vet clinics through Chewy Health to better integrate with its e-commerce operations. It is also expanding its Chewy+ paid subscription service, which helps unlock higher net sales per active customer in certain cohorts. These efforts are positioning the company to accelerate both revenue and profitability growth.

Key Takeaways from Chewy’s Latest Quarterly Results

Chewy reported its Q3 results on December 4th, and broadly speaking, I believe the bullish thesis remains intact, despite some setbacks.

On a positive note, Chewy reported a 4.8% year-over-year revenue growth, reaching $2.88 billion, surpassing estimates. The company added 160,000 new customers quarter-over-quarter, bringing its total to 20.2 million active customers, slightly down from 20.3 million in the prior quarter. This volatility in customer growth is partly due to the pandemic-driven surge in customers from 2020 to 2022, with some churn occurring as those customers mature.

Further, Chewy was able to increase the net sales per active customer to $567 from $544 last quarter. The company has noted that over time, as customers become more familiar with Chewy’s offerings and as Chewy expands its product line, spending tends to increase. This is a positive trend for long-term growth. Additionally, Chewy reported a significant expansion in free cash flow, which more than tripled year-over-year.

Looking ahead, Chewy’s management has become less conservative with its guidance. For Q4, they forecast 13% year-over-year revenue growth and a 6% increase for the full year, with an adjusted EBITDA margin of 4.7%. This is an improvement from the previous forecast of 4-6% sales growth and a 4.6% adjusted EBITDA margin. Given the company’s consistent outperformance in 2024, it’s reasonable to expect this trend to continue in the next quarter.

What’s Worrying Investors About Chewy?

Despite my positive outlook on Chewy’s thesis and the stock being up more than 50% over the course of the year, investors didn’t react well to the Q3 results. The stock dropped from around $34 per share to below $31 immediately after the results were released, though it corrected somewhat in the following days, settling around $31.50.

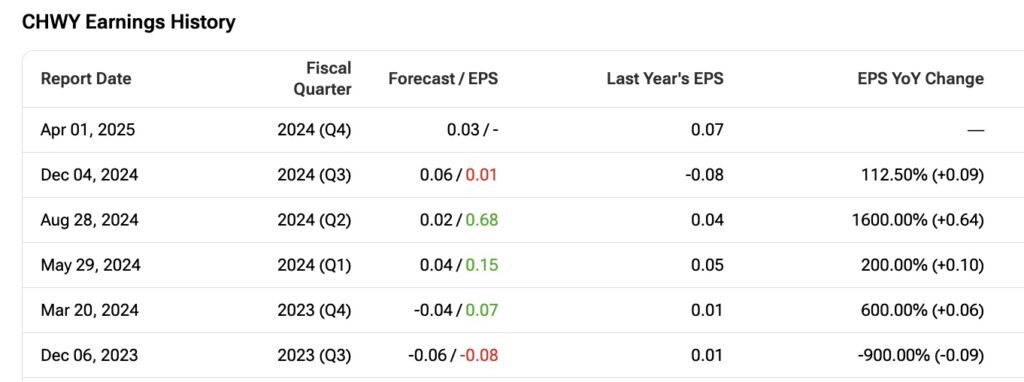

The bearish reaction was mainly due to a miss on Q3 profits. EPS fell 4 cents from Q2 to $0.20, while gross margin dropped 20 basis points. After years of improving margins (from 26.6% in 2021 to 29.2% in the latest 12 months), there has been a concerning downward trend over the past three quarters, with Q1 2024 at 29.7%, Q2 at 29.5%, and Q3 at 29.3%, despite increasing revenue. This is unusual and raises investor concerns about a potential trend.

One potential explanation for the margin decline could be a shift in the product mix. It’s possible that customers are buying more lower-margin items, such as toys, and less of the higher-margin products like pet food. As pet owners increasingly spend on categories that generate lower margins, it could be negatively impacting Chewy’s overall gross profit margin. Additionally, the company’s management had set a long-term target of a 10% adjusted EBITDA margin for 2024, which could make investors more skeptical about achieving this goal given the recent margin trends.

Is CHWY a Good Buy?

Overall, I believe Chewy has made solid progress in monetizing its customer base, which justifies my Buy stance. Considering the recent margin-driven pullback following the earnings report, I attribute the decline more to a sales mix adjustment, which is likely temporary, with margins expected to recover as the trend normalizes. While the stock, currently trading at 25x its forward price-to-earnings (P/E) ratio, is somewhat pricey compared to the industry average of 18x, I believe Chewy deserves a premium due to its recurring revenue business model.

My optimism is also supported by the Wall Street consensus on CHWY. According to TipRanks, Chewy has a Moderate Buy rating based on the views of 21 analysts, with 15 recommending a Buy and 6 issuing Neutral recommendations. The average price target is $37.58, suggesting a potential upside of 21.67% from the current price. This makes it a good opportunity to buy CHWY on the dip.

Conclusion

I view Chewy as a Buy after the earnings pullback. The company showed strong revenue growth, both year-over-year and sequentially, with a more positive Q4 outlook from management. While margin declines raised concerns, I believe this was mainly due to an unfavorable product mix and not a long-term issue—especially with upwardly revised EBITDA margin guidance. Given its solid fundamentals and relatively de-risked valuation, the recent pullback presents a good buying opportunity.