Online pet products retailer Chewy (CHWY) is scheduled to announce its results for the third quarter of Fiscal 2024 before the market opens on December 4. Analysts expect the company to report earnings per share (EPS) of $0.06, marking a significant improvement from the loss per share of $0.08 in the prior-year quarter. Further, Wall Street expects Chewy’s revenue to rise more than 4% year-over-year to $2.86 billion.

CHWY shares have rallied over 42% so far this year, reflecting the company’s resilient performance amid a challenging business backdrop. However, some concerns about intense competition in the pet products and services space and the company’s elevated valuation despite its single-digit revenue growth persist.

Analysts’ Views Ahead of Chewy’s Q3 Earnings

Ahead of the Q3 results, Piper Sandler analyst Anna Andreeva reaffirmed a Buy rating on CHWY stock and raised the price target to $40 from $35 to reflect some signs of improvement in pet adoptions. The analyst noted that buy-side expectations indicate a modest sales and margin beat.

Andreeva explained that CHWY’s guidance for flat net additions for the year implies slightly positive net additions in the second half of the year. While Chewy is generally conservative when it comes to guidance, the analyst thinks that the company could slightly increase its EBITDA outlook again.

It is worth noting that recently Bank of America analyst Curtis Nagle double upgraded CHWY stock from Sell to Buy and boosted the price target to $40 from $24. Despite a year-over-year negative trend in pet spending, Bank of America’s analysis indicates that pet adoption rates have been favorable since the beginning of 2024, suggesting that the worst might be over for the industry.

The rating upgrade was also backed by some company-specific strengths like Chewy’s solid expense management, shift to higher gross margin offerings (like ads and health services), and a notable rise in the company’s web traffic that suggests share gains and the possibility of better-than-anticipated customer count.

Website Traffic Hints at Strong Top-line Growth

For an online retailer like Chewy, website traffic is a vital indicator of financial performance. TipRanks’ Website Traffic Tool indicates that the estimated visits on chewy.com increased 15.1% year-over-year and about 11% sequentially in Q3 FY24. These double-digit growth rates in website traffic bode well for the company’s Q3 revenue.

Options Traders Anticipate a Significant Move

TipRanks’ Options tool offers a quick way to gauge what options traders anticipate from the stock following its earnings report. The expected earnings move is calculated using the at-the-money straddle of the options set to expire closest to the announcement. While this may sound complex, the tool handles the calculations for you.

Currently, it indicates that options traders are predicting about a 12.3% swing in either direction in CHWY stock.

Is CHWY a Good Stock to Buy?

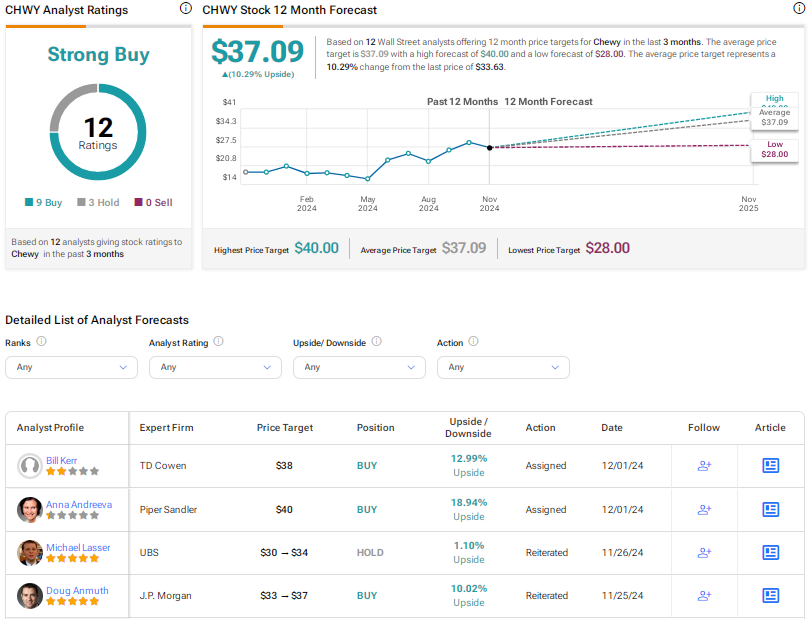

Wall Street is bullish on Chewy stock, with a Strong Buy consensus rating based on nine Buys and three Holds. The average CHWY stock price target of $37.09 implies 10.3% upside potential.