Chevron (CVX) reported Q2 2022 results that both improved significantly from the year-ago quarter and exceeded Wall Street expectations. CVX stock rose about 8.9% to $163.78 on July 29. The stock of the multinational oil and gas giant has gained almost 40% year-to-date.

Earnings Numbers in Detail

Revenue rose to $68.76 billion from $37.6 billion in the year-ago quarter and exceeded the consensus estimate of $59.29 billion. Adjusted EPS of $5.82 jumped from $1.71 in the year-ago quarter and beat the consensus estimate of $5.10.

The strong results were supported by robust demand for oil and gas and high product prices. In the U.S., for example, the average selling price of crude oil and natural gas liquids per barrel was $89, compared to $54 a year ago.

Reduced Debt and Strengthened Stock Buyback Program

Amid the favorable market conditions for oil and gas businesses, Chevron is using its huge profit to strengthen its balance sheet and reward investors. The latest quarter marked the fifth consecutive quarter of debt reduction at Chevron. The company has now lowered its debt ratio to below 15%. Chevron sees a path to net zero debt.

Furthermore, the company returned more than $5 billion to investors through dividends and stock repurchases. It raised its annual stock repurchase target to as much as $15 billion, up from $10 billion previously.

Executive Commentary on Earnings

“Demand, I think will be much more recession resilient going forward just because we have seen a little bit of that response in the second quarter,” said Chevron CFO Pierre Breber during the earnings call.

In an interview with Reuters, the executive said, “We think we can do it all. Grow the dividend to investors, grow traditional and new energy, pay down debt, and buy back shares.”

Wall Street Is Cautiously Optimistic About CVX Stock

The Street is cautiously optimistic about Chevron stock with a Moderate Buy consensus rating, based on nine Buys, six Holds, and one Sell. The average Tesla price target of $178.44 implies about 9% upside potential to current levels.

Best-Performing TipRanks Portfolios Are Buying Chevron Stock

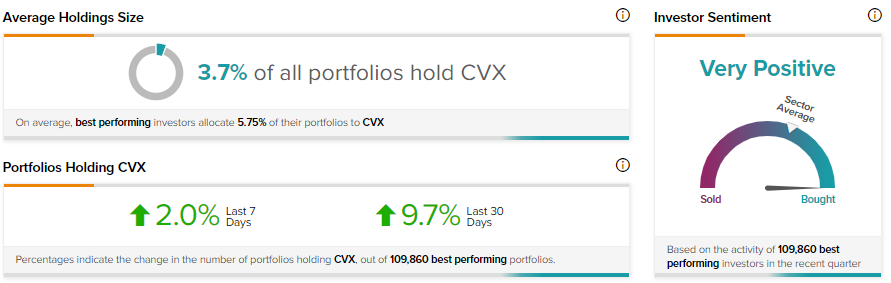

TipRanks’ Stock Investors tool shows that investor sentiment is currently Very Positive on Chevron, with 9.7% of the best-performing portfolios tracked by TipRanks increasing their exposure to CVX stock over the past 30 days.

Perfect Smart Score Hints at Outperformance

Chevron scores a “Perfect 10” from TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Key Takeaway for Investors

For oil and gas companies like Chevron, the business is booming. It is encouraging for investors that Chevron believes that demand is going to remain strong even in a recession. Chevron is making good use of the favorable market, taking advantage of its huge profit to pay down debt and invest in shareholders through dividends and stock repurchases.

Read full Disclosure