U.S. energy giant Chevron Corp. (CVX) has entered into a definitive agreement to buy all of the outstanding shares of Noble Energy, Inc. (NBL) in an all-stock deal valued at $5 billion.

Under the terms of the agreement, Noble Energy shareholders will receive 0.1191 shares of Chevron for each Noble Energy share. The transaction price of $10.38 per share represents a premium of about 7.5% to Noble’s Friday close. Upon deal closure, Noble shareholders will own about 3% of the combined company. The total enterprise value, including debt, of the transaction amounts to $13 billion.

Noble shares rose 6% to $10.22 in morning U.S. trading, while Chevron dropped 1.7% to $85.77.

Chevron said the acquisition provides the company with low-cost, proved reserves and attractive undeveloped resources that will boost an already advantaged upstream portfolio. Noble has low-capital, cash-generating offshore assets in Israel, with which Chevron hopes to strengthen its position in the Eastern Mediterranean.

Noble’s assets would also expand Chevron’s shale position in the DJ Basin of Colorado and the 92,000 largely contiguous and adjacent acres in the Permian Basin across West Texas and New Mexico.

“Our strong balance sheet and financial discipline gives us the flexibility to be a buyer of quality assets during these challenging times,” said Chevron CEO Michael Wirth. “This is a cost-effective opportunity for Chevron to acquire additional proved reserves and resources. Noble’s multi-asset, high-quality portfolio will improve our ability to generate strong cash flow.”

Wirth said that the deal is expected to unlock value for shareholders, generating $300 million in annual run-rate cost synergies, while also adding to free cash flow, and earnings per share returns one year after closing.

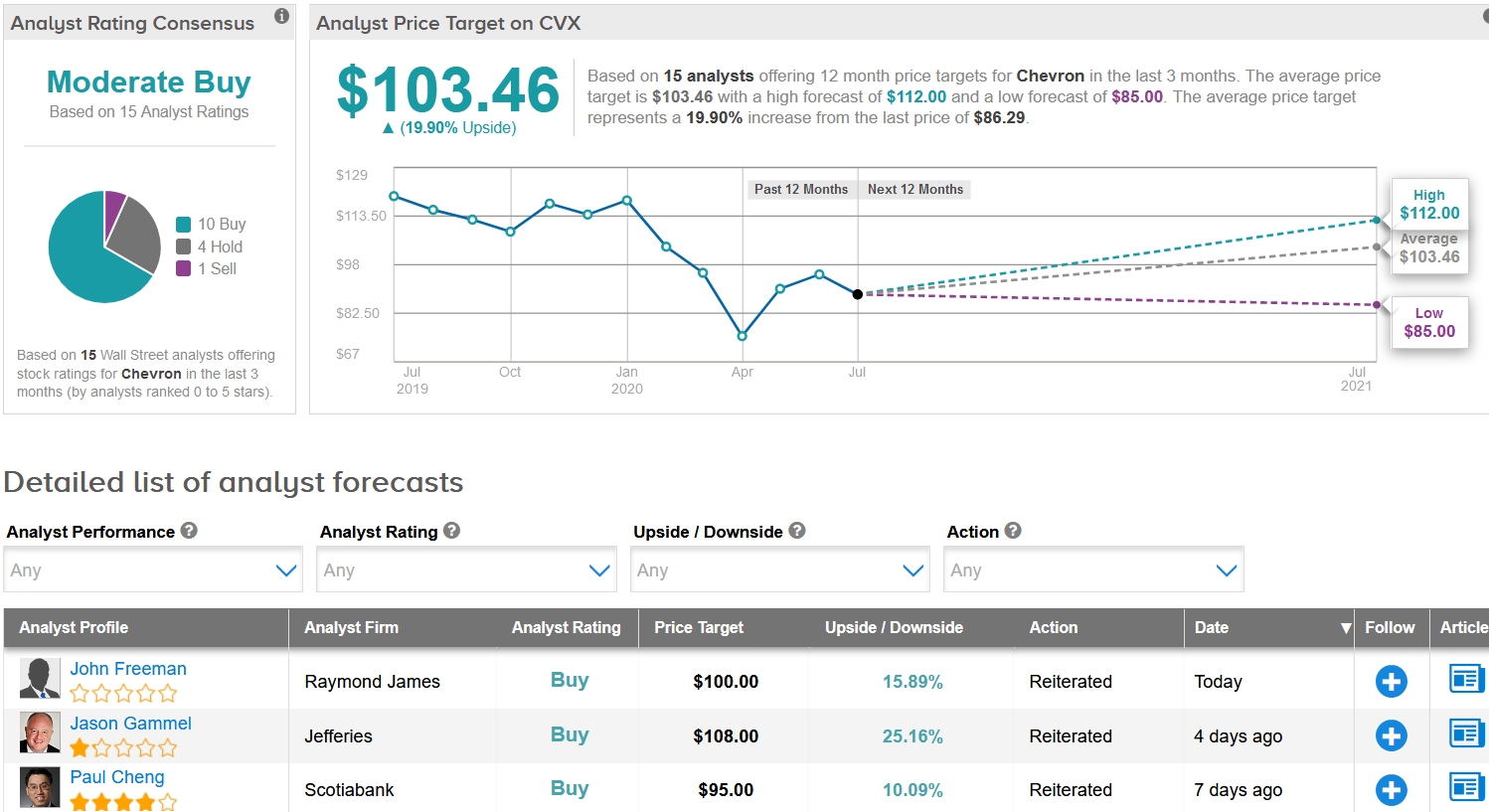

Raymond James analyst John Freeman today raised Chevron’s price target to $100 (16% upside potential) from $95, while maintaining a Buy rating on the stock.

With shares down 28% so far this year, Wall Street analysts are cautiously optimistic on the stock’s outlook. The Moderate Buy consensus breaks down into 10 Buy ratings versus 4 Hold ratings and 1 Sell rating.

The $103.46 average analyst price target indicates 20% upside potential from current levels over the next 12 months. (See Chevron stock analysis on TipRanks).

Related News:

BP Invests $1B In Fuels Joint Venture With Reliance In India

Sunrun To Buy Vivint Solar For About $1.46B In All-Stock Deal

Billionaire Buffett’s Energy Unit To Buy Dominion Energy Assets For $4B