Exxon Mobil and Chevron talked about a merger last year as the COVID-19 pandemic resulted in an oil price slump due to low demand, the Wall Street Journal reported. According to the report, the preliminary merger discussions between the two oil giants are not currently on-going but a tie-up could be discussed again in the future.

Don't Miss Our New Year's Offers:

- Discover the latest stocks recommended by top Wall Street analysts, all in one place with Analyst Top Stocks

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

As of Jan. 29, Chevron (CVX) had a market cap of $164 billion, and Exxon had a market cap of $189.6 billion. A possible merger could result in a company with a combined market cap of $353.6 billion. CVX and XOM both rose about 1.9% in Monday’s pre-market trading session.

According to the Wall Street Journal report a possible merger could result in creating the second-largest oil company in the world in terms of market cap and production as the combined companies produced about 7 million barrels of oil and gas as based on their production levels before the pandemic.

However, a potential deal could face regulatory and antitrust hurdles under President Joe Biden’s administration, the report said.

Exxon (XOM) is expected to report its 4Q earnings on Feb. 2. Earlier this month, JP Morgan analyst Phil Gresh upgraded the stock from Hold to Buy and raised his price target from $50 to $56.

Gresh wrote in a note to investors, “For the first time in seven years of covering integrated oils since the peak of the sector in 2014, we are upgrading [Exxon] to overweight.” (See Exxon Mobil stock analysis on TipRanks)

“As we sit here today, we think that the bar is materially lower, execution might finally be turning a corner, 2021 consensus is too low (even at $50/bbl [barrel of oil]. Brent), the >7% dividend yield is more secure and valuation is more reasonable. Perhaps most importantly, we think that capital discipline is improving, with the [$20 billion to $25 billion] capex budget a self-imposed step required to preserve the dividend and balance sheet.” Gresh added.

Last week, Chevron reported its 4Q results and posted an adjusted loss of $0.01 per share, compared to analysts’ expectations of earnings per share of $0.08. The company’s revenues of $25.3 billion missed the Street estimates of $26.2 billion and declined 30.5% year-over-year. (See Chevron stock analysis on TipRanks)

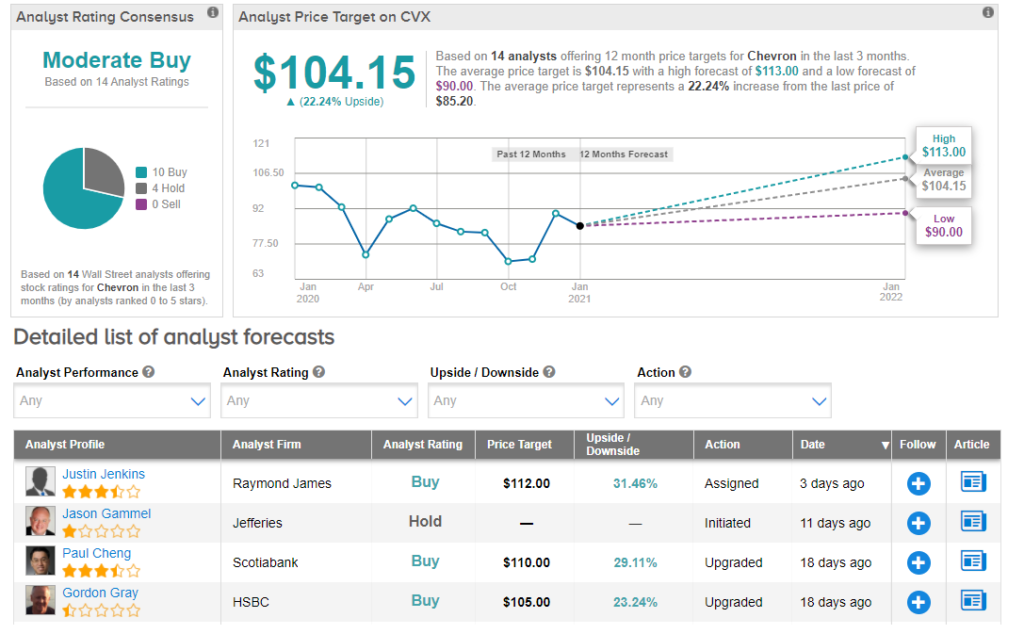

Following the results, Raymond James analyst Justin Jenkins on Jan. 29 maintained a Buy rating and a price target of $112 (31.5% upside potential) on the stock, “based on a more secure balance sheet, solid leverage to a macro/oil price recovery and capital allocation that is already aligned with investor preferences.”

The rest of the Street is cautiously optimistic about Chevron with a Moderate Buy consensus rating. That’s based on 10 analysts recommending a Buy and 4 analysts suggesting a Hold. The average analyst price target of $104.15 implies 22.2% upside potential to current levels.

Related News:

BP Sells $2.6B Oman Gas Block Stake To Thailand’s PTT

Roper Technologies Dips 7% On 1Q Profit Outlook Miss

FB Financial Ramps Up Dividend By 22%