One of the top Oil Stocks Chesapeake Energy (NASDAQ: CHK) is close to finalizing its acquisition of privately-owned natural gas producer, Chief Oil & Gas for an expected amount of $2.4 billion, according to Reuters.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Chesapeake Energy Corp is a US-based exploration and production company that engages in the acquisition, exploration, and development of properties for the production of oil, natural gas and natural gas liquids from underground reservoirs.

Chesapeake’s Renewed Focused on Natural Gas Post Bankruptcy

Chesapeake Energy filed for bankruptcy last year, making it one of the biggest bankruptcies in the history of the oil industry. `Chesapeake is now on a path to recovery and its shares have gained 50% over the past year.

Currently, the company is focused on natural gas production, since natural gas prices continue to spike to multi-year highs.

Likewise, in November, Chesapeake acquired Vine Energy, a pure play natural gas company focused on the development of natural gas properties, in the stacked Haynesville Basin of Northwest Louisiana, for $615 million.

About Chief Oil & Gas

Founded in Dallas, Texas, in 1994 by Trevor Rees-Jones, Chief Oil & Gas produces more than 1 billion cubic feet per day (bcf/d) of natural gas. It has around 600,000 net acres in the Marcellus shale in the north-eastern Pennsylvania region in the U.S.

According to Reuters, Chief Oil & Gas was available for sale in October 2021. A recent increase in energy prices has boosted corporate valuations across the industry.

However, it is still uncertain if the deal will be closed or not subject to certain conditions.

Wall Street’s Take

On January 10, BofA analyst Doug Leggate initiated coverage of Chesapeake with a Buy rating and the price target of $90 (33.3% upside potential).

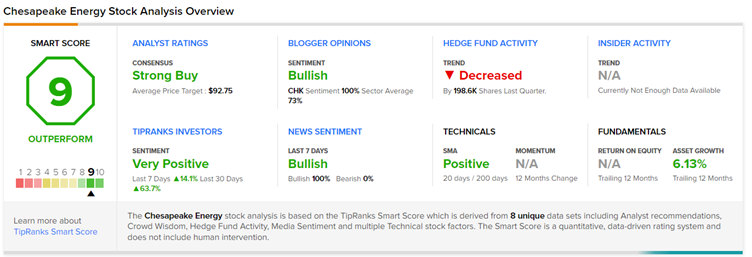

Overall, consensus among analysts is a Strong Buy based on 8 unanimous Buys. The average Chesapeake Energy stock forecast of $92.75 implies 37.4% upside potential to current levels.

TipRanks’ Smart Score

CHK scores a 9 out of 10 on TipRanks’ Smart Score rating system, indicating that the stock has strong potential to outperform market expectations.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

UCB to Acquire Zogenix; ZGNX Shares Surge 66%

Peloton May Hike Prices & Cut Jobs; Shares Plunge 3.5%

Charles Schwab Misses Q4 Expectations, Shares Drop 3.5%