ChemoCentryx and Vifor Fresenius Medical Care Renal Pharma (VFMCRP) on Dec. 21 released clinical trial data, which evaluated avacopan used in the treatment of rare kidney disease C3 Glomerulopathy (C3G).

Patients in the randomized clinical trial received either 30mg of avacopan twice daily (BID) or placebo for 26 weeks in a double-blind manner. ChemoCentryx (CCXI) shares lost 7.9% in Monday’s after-hours trading, as the company said that the trial showed that the change from baseline to week 26 in C3G Histologic Index (C3G HI) for disease activity (primary endpoint) was not statistically different between the two treatment groups.

However, the C3G HI for Disease Chronicity measuring progression of fibrosis proved a significant benefit for avacopan versus placebo. Avacopan is an orally administered small-molecule C5aR antagonist that blocks the effects of C5a.

“The data from this well-controlled, blinded placebo comparison trial provides evidence that avacopan can improve kidney function in C3G” said Thomas J. Schall, CEO of ChemoCentryx.

According to the C3G Activity Score, biopsies collected at baseline and after 26 weeks of treatment showed that the placebo group worsened by 38% compared to a 2% improvement by the avacopan group. Patients who received avacopan noted significant benefits in terms of kidney function and other parameters compared to those who received a placebo according to the trial.

Going forward, ChemoCentryx intends to discuss the results with the U.S. Food and Drug Administration (FDA).

ChemoCentryx stock has gained 51% year-to-date. (See CCXI stock analysis on TipRanks)

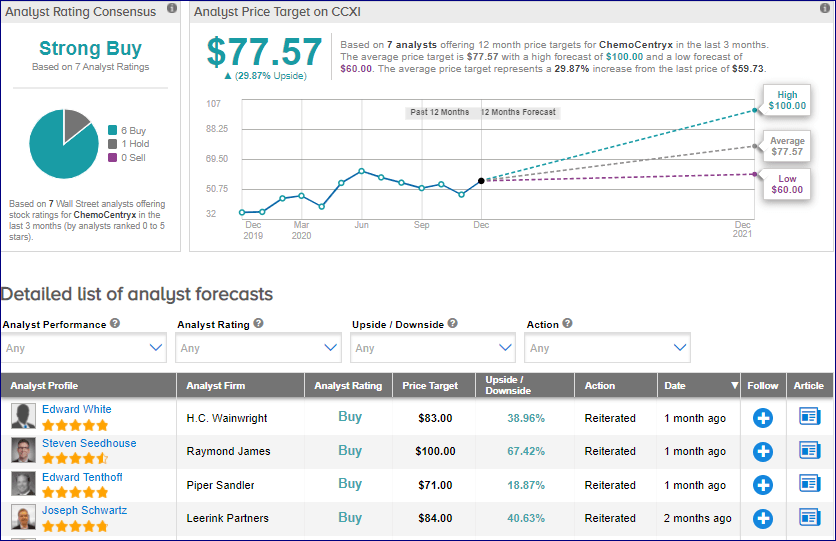

Last month, Piper Sandler analyst Edward Tenthoff reiterated a Buy rating on the CCXI stock with a price target of $71 (a 19% upside potential).

Tenthoff said that he remains confident that the company will be granted FDA approval of avacopan, with a US launch expected in the second half of 2021, and the European regulatory approval in the second half.

From the rest of the Street, the stock scores a Strong Buy analyst consensus based on 6 Buys and 1 Hold. The average price target of $77.57 implies upside potential of about 30% to current levels.

Related News:

Monday’s Market Snapshot: Here’s What You Need To Know Right Now

Boeing Wins Fourth Contract With Singapore Air Force; Shares Down 33% YTD

Wells Fargo To Resume Share Buyback In 1Q; Shares Rise 3%