Shares of Chegg jumped 4.8% in Tuesdays pre-market trading session after the education platform reported better-than-expected 4Q results fueled by a substantial increase in subscriber numbers.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Chegg’s (CHGG) 4Q earnings increased 57% to $0.55 per share on a year-over-year basis, beating Street estimates of $0.49 per share as the company benefited from the increased demand for remote learning during the coronavirus pandemic. Revenue grew 64% to $205.72 million and surpassed the consensus mark of $189.55 million.

Chegg Services revenues came in at $176 million, up 64% year-over-year. The number of subscribers jumped 74% to 4.4 million. (See Chegg stock analysis on TipRanks)

Chegg CFO Andy Brown commented, “Based on the momentum we experienced exiting Q4 and the strength we are seeing in subscriber growth in early Q1, we are raising our guidance. We expect continued strong growth in the US, and increased contribution internationally where we expect to surpass one million subscribers in 2021. This will be slightly offset by reduced Required Materials revenue due to lower enrollments.”

For 2021, the company projects net revenue to be in a range of $780 million to $790 million versus analysts’ expectations of $780.2 million. Chegg Services sales are forecasted to generate between $665 million and $675 million. Adjusted EBITDA is expected to be in the range of $265 million to $270 million.

For 1Q, net revenue is anticipated to be in the range of $182 million to $185 million versus the consensus score of $174.8 million. Adjusted EBITDA is estimated to be between $48 million to $50 million.

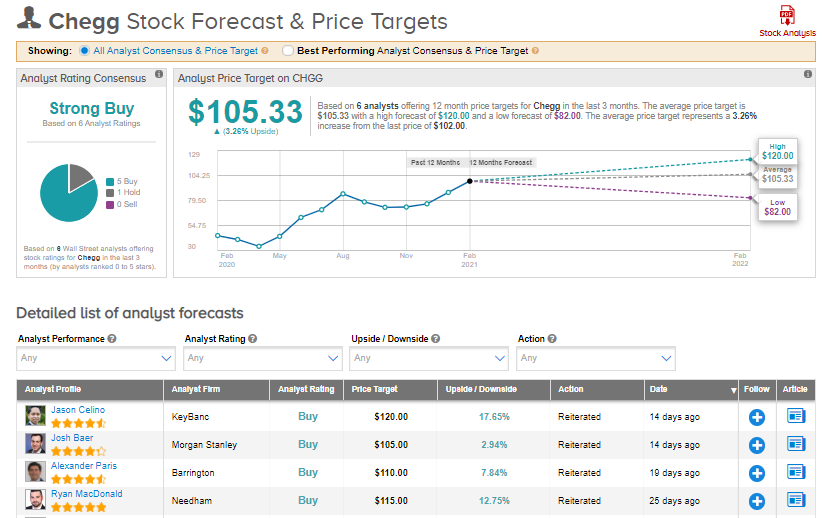

On Jan. 21, Barrington analyst Alexander Paris increased the stock’s price target from $95 to $110 (7.8% upside potential) and maintained a Buy rating. The analyst noted, the company’s “premium valuation is justified, however, given its sustainable, superior revenue growth rate and high and rising profitability, combined with a balance sheet including nearly $1.8 billion in cash to finance further growth initiatives including strategic acquisitions.”

Shares have rallied 138.8% over the past year, while Wall Street analysts are still bullish about the stock. The Strong Buy consensus rating boasts 5 Buy ratings versus only 1 Hold rating. Looking ahead, the average analyst price target stands at $105.33, putting the upside potential at about 3.3% over the next 12 months.

Related News:

Global Payments Announces Mixed Results, Strategic Partnership With Google

Peloton’s 2Q Results Top Estimates But Delivery Delays Push Shares Down

Linde’s 1Q Profit Outlook Tops Estimates After 4Q Beat; Shares Gain