Shares of Chegg, Inc. (CHGG) plunged 29.1% in the extended trading session on Monday after the education technology company provided disappointing fourth-quarter 2021 guidance. The company has also posted lower-than-expected revenues for the third-quarter 2021.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Chegg registered net revenues of $171.9 million, missing the Street’s estimate of $174.54 million. Net revenues were, however, up 12% from the same quarter last year. Chegg services revenues rose 23% to $146.8 million.

Meanwhile, third-quarter adjusted earnings of $0.20 per share came in line with analysts’ expectations. The company had reported adjusted earnings of $0.17 per share in the same quarter last year.

Additionally, adjusted EBITDA came in at $46.4 million, up 45.5% year-over-year.

See Analysts’ Top Stocks on TipRanks >>

In November 2021, Chegg’s board of directors increased its existing securities repurchase program by $500 million. The total repurchases authorization stands at $1 billion of its common stock and convertible notes.

In response to the third-quarter results, the CEO of Chegg, Dan Rosensweig, said, “Over the last year and a half, we experienced extraordinary growth and, in midst of a strong year, had a solid third quarter, growing Chegg Services revenue 23% year-over-year. However, in late September it became clear to us that the education industry is experiencing a slowdown that we believe is temporary and is a direct result of the COVID-19 pandemic.” (See Chegg stock charts on TipRanks)

Guidance

The CFO of Chegg, Andy Brown, said that industry headwinds emerged in North American markets late in the third quarter. Consequently, the company has lowered its guidance.

For the fourth quarter of 2021, Chegg now expects total net revenues between $194 million and $196 million, down from the consensus estimate of $240.6 million. Additionally, it anticipates Chegg services revenues in the range of $175 million to $177 million.

For 2021, total net revenues are anticipated to be between $762 million and $764 million. Further, services revenues are likely to be in the range of $657 million to $659 million.

Analysts Recommendation

Consensus among analysts is a Strong Buy based on 9 Buys and 1 Hold. The average Chegg price target of $100.25 implies 59.74% upside potential from current levels.

Website Traffic

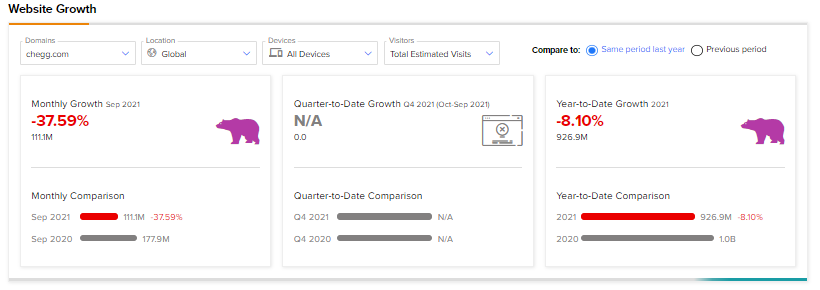

TipRanks’ Website Traffic Tool, which uses data from SEMrush Holdings (SEMR), the world’s biggest website usage monitoring service, offers insight into Chegg’s performance. According to the tool, the Chegg website recorded a 37.59% monthly decline, year-over-year, in global visits in September. Notably, year-to-date website growth, compared to year-to-date website growth in the previous year, registered a decline of 8.1%.

Related News:

Ocugen Submits IND Application for COVAXIN

Apple Drops 3.5% as Q4 Revenues Disappoint, Supply Crunch Hurts

AbbVie’s 2021 Earnings Outlook Exceeds Estimates; Shares Up 4.6%