Artificial Intelligence (AI) ETFs offer investors diversified exposure to a range of AI-focused companies, ranging from established tech giants to smaller startups. Further, AI ETFs offer a convenient and cost-effective way to invest in this sector. Using the TipRanks ETF Screener, we have shortlisted two AI ETFs with over 20% upside potential: Roundhill Generative AI & Technology ETF (CHAT) and Invesco AI And Next Gen Software ETF (IGPT).

Let’s take a closer look at what Wall Street thinks about these two ETFs.

Roundhill Generative AI & Technology ETF (CHAT)

The CHAT ETF is an actively managed fund that targets companies globally that seem well-positioned to benefit from the growth of generative AI and related technologies.

CHAT has $189.79 million in assets under management (AUM), and its expense ratio stands at 0.75%. Interestingly, the CHAT ETF has gained 15.2% in the past year.

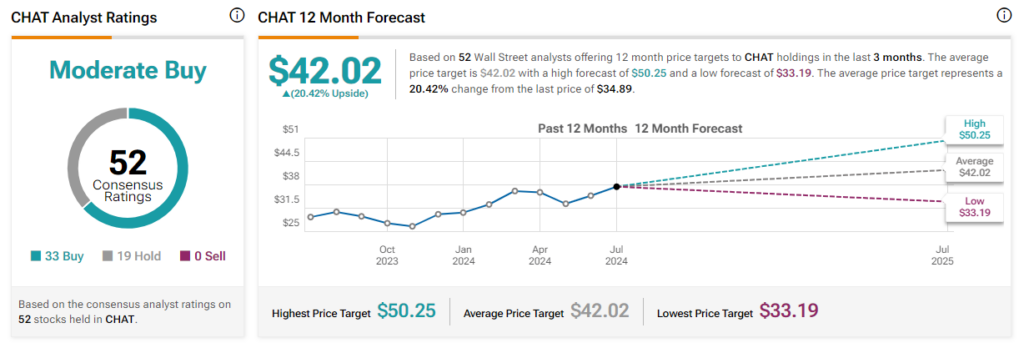

On TipRanks, the CHAT ETF has a Moderate Buy consensus rating. This is based on the consensus rating of 52 stocks held in the portfolio. Of the stocks held, 33 have Buys and 19 have a Hold rating. The analysts’ average price target on CHAT ETF of $42.02 implies a 20.4% upside potential from the current levels.

Invesco AI And Next Gen Software ETF (IGPT)

The IGPT ETF provides exposure to the rapidly growing AI and next-generation software sectors. It tracks the Stoxx World AC NexGen Software Development Index, which targets companies from across the globe providing data storage, robotics, autonomous vehicles, semiconductors, and web platforms.

IGPT has $375.15 million in AUM. Meanwhile, the ETF’s low expense ratio of 0.6% is encouraging. The IGPT ETF has generated a return of about 19% over the past year.

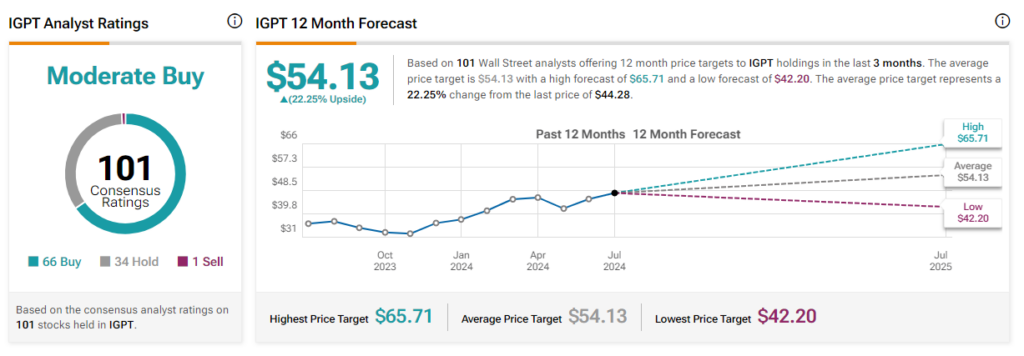

Overall, IGPT has a Moderate Buy consensus rating. Of the 101 stocks held, 66 have Buys, 34 have a Hold rating, and one stock has a Sell rating. The analysts’ average price target on IGPT ETF of $54.13 implies an 22.25% upside potential from the current levels.

Concluding Thoughts

AI ETFs are an affordable and transparent way to gain exposure to this dynamic industry. Furthermore, these ETFs have better liquidity, making it easier for investors to engage in buy or sell transactions.