Charter Communications (NASDAQ:CHTR) shares plunged by nearly 15% today after the telecommunications company’s fourth-quarter EPS of $7.07 lagged expectations by $1.69. Further, revenue of $13.71 billion landed in line with estimates.

In Q4, the number of Charter’s total residential and small and medium (SMB) business internet customers declined by 61,000. On the other hand, its total residential and SMB mobile lines ticked higher by 546,000. Further, the company’s residential internet revenue increased by 3%, and residential mobile service revenue increased by 35.7%. However, total top-line growth for the quarter came in at a marginal 0.3%.

Additionally, higher capital expenditures resulted in the company’s full-year free cash flow declining to $3.5 billion from $6.1 billion in the prior year. Moreover, its total video customers decreased by 6.8%, and total voice customers declined by 10.9% in 2023. The company’s total outstanding debt at the end of Q4 stood at $97.6 billion.

What Is the Stock Price Forecast for CHTR?

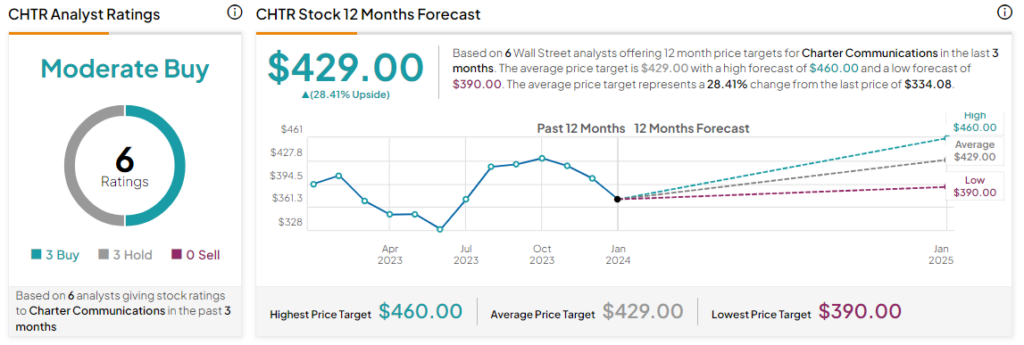

With today’s value erosion, the company’s share price has now corrected by nearly 38% over the past three years. Overall, the Street has a Moderate Buy consensus rating on Charter, and the average CHTR price target of $429 points to a 28.4% potential upside in the stock.

Read full Disclosure