Financial services company Charles Schwab (NYSE:SCHW) gained in trading on Monday even as it reported adjusted earnings of $0.77 per share in the third quarter, a drop of 30% year-over-year but above consensus estimates of $0.74 per share. The company’s revenues dropped by 16% year-over-year to $4.6 billion as compared to Street estimates of $4.64 billion.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

More encouragingly, the company had core net new assets of $46 billion at the end of the third quarter, including $27 billion worth of assets in September. As of September 30, Schwab has a total of $7.82 trillion in client assets. The company’s asset management and administration fees went up by around 17% to $1.22 billion.

Looking forward, Schwab sees net interest margin (NIM) rebounding through next year and approaching 3% by the end of 2025. The company anticipates revenues to decline in the range of 8% to 9% year-over-year in FY23, compared with Street estimates of a decline of 7.9%. On an adjusted basis, expenses are seen climbing by 6% in FY23.

Is Charles Schwab a Good Stock to Buy Now?

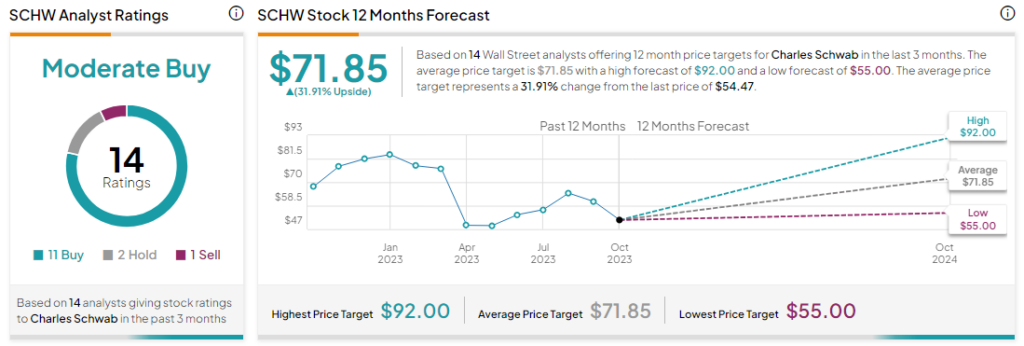

Analysts are cautiously optimistic about Schwab, with a Moderate Buy consensus rating based on 11 Buys, two Holds, and one Sell. The average SCHW price target is $71.85, implying an upside potential of 31.9% from current levels.