ChargePoint Holdings, Inc. (NYSE: CHPT), an American electric vehicle infrastructure company, has reported a wider-than-expected loss in the fourth quarter of Fiscal Year 2022. Meanwhile, net revenues surpassed analysts’ expectations.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Following the revenue beat, shares of the company jumped 5.61% in the extended trading session on Wednesday after closing 1.5% lower on the day.

Remarkably, the company exceeded the high-end range of both the quarterly and annual revenue guidance.

Results in Detail

For Fiscal 2022, ChargePoint posted a loss of $1.49 per share, significantly down from the loss of $18.14 per share recorded in Fiscal 2021. Total revenues came in at $242.3 million, up 65%.

Quarterly speaking, ChargePoint incurred a loss of $0.23 per share against the Street’s loss estimate of $0.15 per share. However, the loss declined significantly from the year-ago quarter’s loss of $5.31 per share.

Total revenues generated during the quarter grew 90% year-over-year and came in at $80.7 million, beating the consensus estimate of $76.77 million. Growth in revenues in North America and Europe across ChargePoint’s commercial, fleet, and residential verticals acted as tailwinds.

Segment-wise, networked charging revenue was $59.2 million, up 109% year-over-year, while subscription revenue grew 57% to $17.2 million.

Adjusted gross margin came in at 24%, up from 22% recorded in the prior-year quarter.

As of December 31, 2021, the company had more than 174,000 activated ports, including 51,000 in Europe.

Guidance and Outlook

For the first quarter of Fiscal 2023, the company projects revenue in the range of $72 million to $77 million.

For Fiscal 2023, the company expects revenue of $450 million to $500 million, versus the consensus estimate of $379 million.

Encouragingly, the CEO of ChargePoint, Pasquale Romano, said, “We had numerous successes in our first year as a publicly traded company, including a 65 percent year over year increase in annual revenue, two strategic acquisitions, expansion of our activated port count by over 60 percent, and growing our team of world class talent.”

Bloggers Weigh In

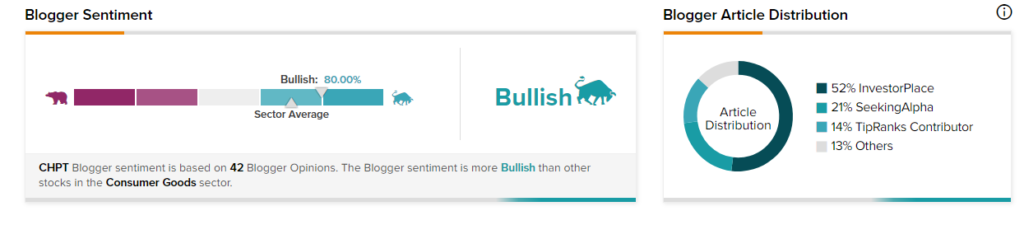

Bloggers seem enthused by the company’s earnings results. TipRanks data shows that financial blogger opinions are 80% Bullish on CHPT, compared to a sector average of 70%.

Wall Street’s Take

The Street is cautiously optimistic about the stock and has a Moderate Buy consensus rating based on seven Buys and three Holds. The average ChargePoint price target of $26.30 implies 86.92% upside potential from current levels. Shares have fallen 50.3% over the past year.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

AMC Entertainment Books Smaller-than-Feared Q4 Loss

Baidu Posts Upbeat Q4 Results; Shares Jump 7%

DexCom Granted FDA Breakthrough Designation for Hospital CGM System